Changing World, Yes, But Is Doom Coming?

Everyone has been talking about doom and gloom and how things are breaking up - including us. But is it really "doom time"? We share a practical indicator based dashboard for you to make your own determination.

In a quiet valley, a great river wound its way to the sea. On one bank stood the Old Bridge, built of stone and iron. It had carried travelers for eighty years and was believed to be the only way to cross the river without it.

One morning, the Old Bridge noticed a wooden frame rising downstream. “What foolishness,” it scoffed. “A new bridge of bamboo and rope cannot last a season.”

The New Bridge only smiled and said nothing.

Seasons passed. Caravans carrying spices, grain, and gold began to cross the New Bridge. It swayed with the wind yet never broke. The Old Bridge watched, puzzled, as more travelers chose the flexible bridge over its solid arches.

One stormy night, a mountain stream burst its banks, bringing a flood. The heavy stones of the Old Bridge cracked under the sudden force and slipped into the river.

At dawn, the travelers saw only one bridge left standing — the swaying New Bridge, still fastened to the living bamboo that bent but did not break.

A young monk asked the abbot, “Master, why did the old one fall?”

The abbot replied,

“The stone bridge trusted its strength. The bamboo bridge trusted the river’s flow.

The world shifts like water — those who cling to weight alone sink when the current changes.”

And so the caravan crossed the New Bridge toward the sunrise, while the river carried away the last stones of the Old.

SUPPORT DRISHTIKONE

In an increasingly complex and shifting world, thoughtful analysis is rare and essential. At Drishtikone, we dedicate hundreds of dollars and hours each month to producing deep, independent insights on geopolitics, culture, and global trends. Our work is rigorous, fearless, and free from advertising and external influence, sustained solely by the support of readers like you. For over two decades, Drishtikone has remained a one-person labor of commitment: no staff, no corporate funding — just a deep belief in the importance of perspective, truth, and analysis. If our work helps you better understand the forces shaping our world, we invite you to support it with your contribution by subscribing to the paid version or a one-time gift. Your support directly fuels independent thinking. To contribute, choose the USD equivalent amount you are comfortable with in your own currency. You can head to the Contribute page and use Stripe or PayPal to make a contribution.

The Gold Vaults

Is dedollarization real? Or is the goal to dollar deweaponize? Well, one does not preclude the other. In fact, dedollarization will necessarily lead to dollar deweaponization.

However, the world, as we discussed in an earlier newsletter, is working on the dollar deweaponization without bringing about dedollarization.

In this scenario, something rather interesting emerges. Use of gold as a backup guarantee for the Chinese renminbi (RMB) in China's trades. They are using the concept of gold vaults.

Shanghai Gold Exchange Hong Kong Vault and Contracts

In June 2025, the Shanghai Gold Exchange (SGE) took a major step toward globalizing its bullion market by launching two new yuan-denominated spot contracts — iPAu99.99HK and iPAu99.5HK — alongside the opening of a Hong Kong-certified vault. Market watchers often describe this as China’s first proper “offshore” gold-vault facility linked directly to the SGE’s domestic trading platform. By locating the vault in Hong Kong, the exchange provides international traders, refiners, and central banks with direct cross-border access to SGE settlement, eliminating the need to route metal through the Chinese mainland’s capital-control regime.

Financial media such as Bloomberg interpret the move as a calculated attempt to expand yuan-denominated bullion trading volumes and to court foreign central-bank and institutional bullion holders who want proximity to Asia’s largest consumer market but prefer Hong Kong’s legal and logistical advantages.

Recent reporting also suggests that Beijing is actively encouraging foreign — especially central-bank — gold reserves to be stored or traded through the SGE system. The pitch: Foreign institutions can warehouse bullion within the SGE ecosystem while participating in a yuan-settled trade network, thereby insulating themselves from certain dollar-clearing constraints.

China as a Bullion hub?

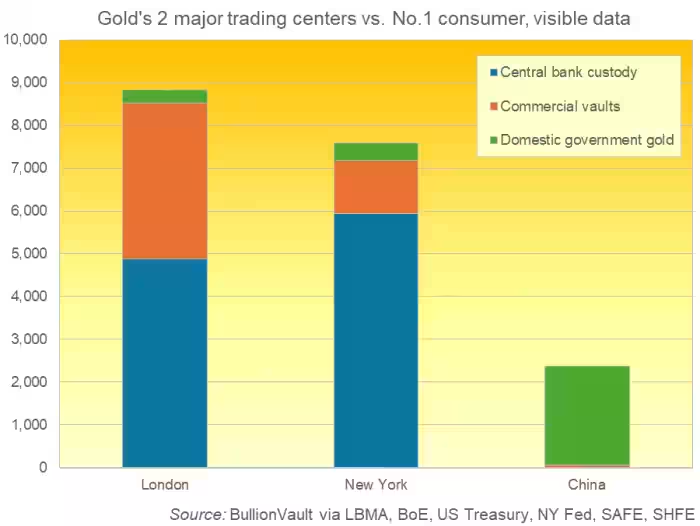

China is today the world's largest gold miner, a net importer, a leading central-bank buyer, and one of the world’s top consumer markets for bullion. Yet, despite this dominance in production and demand, the country has never developed an accurate bullion-banking market. Gold trading on the Shanghai Gold Exchange (SGE) has mainly remained domestic and tightly controlled, limiting China’s influence over global price discovery.

That is beginning to change. Beijing’s central bank has signaled its ambition to transform the SGE into a bridge for international sovereign gold holdings. According to multiple financial reports, the People’s Bank of China is exploring ways to act as custodian of foreign central bank gold reserves, encouraging “friendly” countries to purchase bullion and store it in Chinese-linked vaults. The logic is straightforward: a deeper pool of gold inside China could underpin leasing and lending markets, the foundation of modern bullion banking.

Specialists in precious metals research note that for such a market to flourish, two structural changes would still be needed.

- First, easing restrictions on bullion exports so that Chinese prices track global benchmarks more closely;

- Second, moving the renminbi toward fuller convertibility, a shift that so far shows no sign of imminent approval.

We have seen, and top analysts confirm, that countries in these turbulent times are preferring to keep their bullion within their borders.

The World Gold Council considers London’s bullion market, the U.S. futures market and the Shanghai Gold Exchange to be the three most important gold-trading centers in the world. (Source: Marketwatch)

London and New York have established a certain level of trust over the last century or so, and for Beijing to do something similar is not easy. That is why China’s bid to become a global gold-banking center may face resistance.

In this context, SGE is now establishing an offshore vault in Hong Kong and introducing new yuan-denominated contracts.

This strategy could expand the international use of the renminbi in gold-backed transactions, strengthening China’s influence in global pricing, and offering an alternative settlement channel for central banks seeking to diversify away from the U.S.-dollar-centric system.

The First Hong Kong Gold Vault

The Shanghai Gold Exchange (SGE) established its first offshore physical gold delivery vault in Hong Kong in June 2025, alongside two new yuan-denominated contracts, to expand its global reach and promote yuan-based gold trading.

The vault, operated by Bank of China (Hong Kong), allows for both cash and physical delivery settlements, aiming to challenge the dollar's dominance in gold trading and strengthen China's influence in commodity markets.

This is the first of the many such initiatives.

The SGE's establishment of a certified vault in Hong Kong will, on one hand, attract more international investors to participate in the SGE's trading and, at the same time, increase gold storage in Hong Kong, thus driving the development of related services. (Source: Finews Asia)

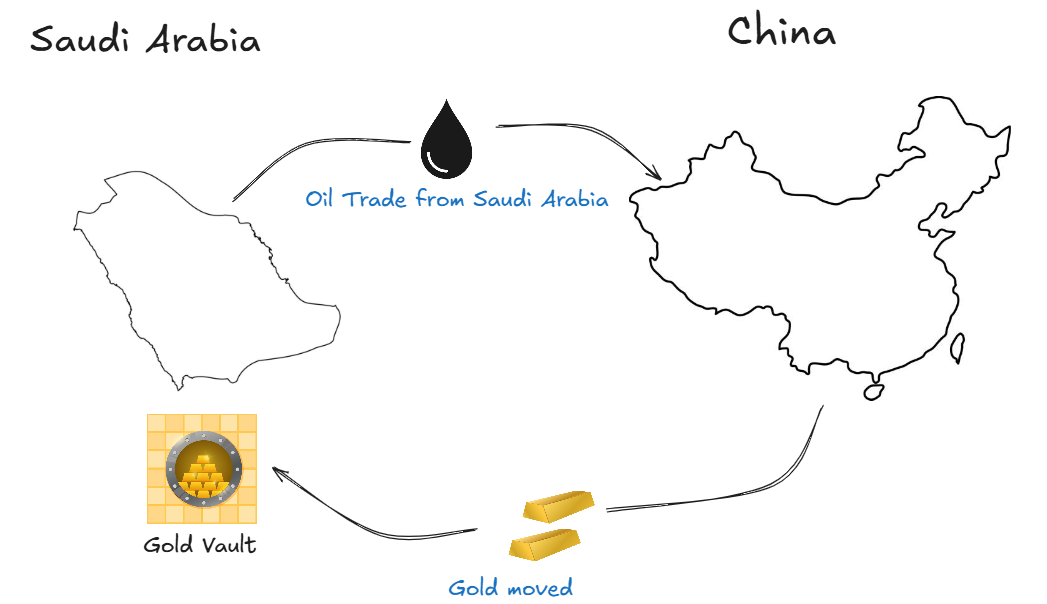

Saudi Arabia is another location for gold vaults.

Riyadh-based Gold Vault

Let us check the details of the Riyadh based gold vault out.

So, essentially, China plans to establish a Shanghai Gold Exchange International (SGEI) vault in Saudi Arabia, positioning it as the centerpiece of its overseas gold settlement network.

The vault is designed to allow Saudi oil exporters to invoice and settle crude sales in Chinese renminbi (RMB) instead of U.S. dollars, then convert the surplus RMB—estimated at approximately $30 billion—directly into gold stored on-site. By linking oil revenues to gold, the arrangement would cushion both sides against U.S.-dollar exchange rate swings and reduce their dependence on dollar-clearing banks.

If implemented at scale, the facility would form the core loop of an RMB-gold-oil triangle between China and the Gulf: Chinese buyers pay in RMB; Saudi exporters receive RMB but can instantly exchange it for vaulted gold; the pricing and custody remain under the SGEI framework rather than Western exchanges.

This hub could become the model for similar RMB-gold settlement points across other BRICS energy producers.

But the gold-vault-linked RMB oil trade is not the only gold-vault-RMB endeavor by the Chinese. They are using it everywhere. Let us take a look.

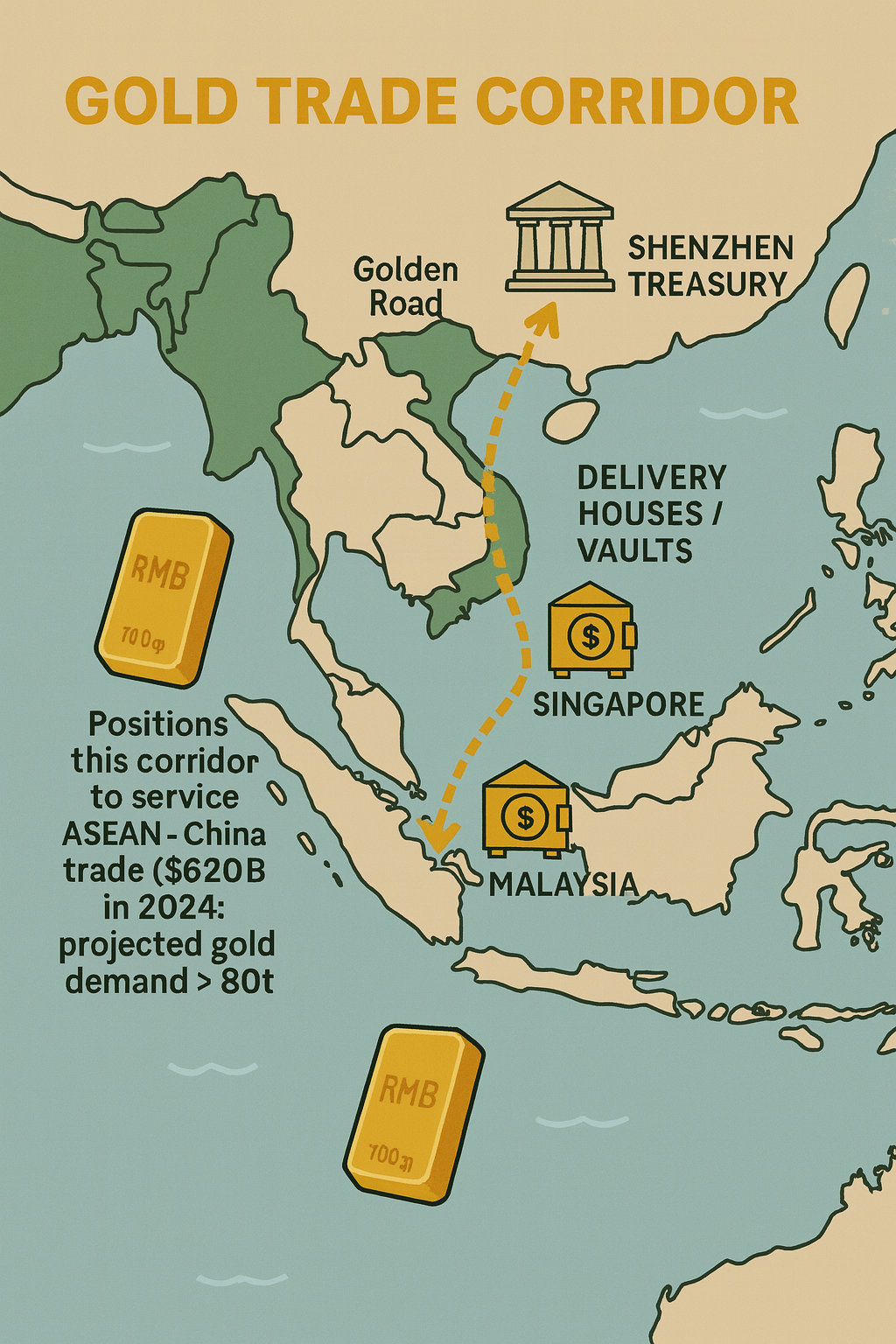

Southeast Asia Gold-Vault-backed initiatives

China’s second significant step toward a global gold-settlement network focuses on Southeast Asia, where it is building a corridor of delivery houses and vaults in Singapore and Malaysia to handle cross-border bullion flows.

These facilities shorten logistics routes between the Shanghai Gold Exchange International (SGEI) system and regional financial hubs, giving banks, refineries, and investors faster access to RMB-linked bullion.

A centerpiece of this effort is the “Golden Road,” an over-land logistics link coordinated by the Shenzhen Treasury that connects southern China directly to Macau and on to Southeast Asian vaults.

By bypassing certain maritime and customs bottlenecks, the route reportedly reduces transportation and handling costs by approximately 30 percent.

The resulting savings improve margins for refiners and dealers, making RMB-priced bullion more attractive to traders throughout ASEAN.

To broaden participation beyond institutional players, the network has also introduced 100-gram, RMB-denominated gold bars.

These smaller, standardized bars are easier for individual investors, small businesses, and regional banks to buy, store, or use as collateral.

The move is designed to lower entry barriers for retail buyers and stimulate gold consumption as a savings and investment vehicle across Southeast Asia.

The corridor is designed to serve the rapidly growing ASEAN–China trade zone, which recorded approximately US $620 billion in two-way trade in 2024.

Regional demand for physical gold is forecast to exceed 80 tons annually, offering a substantial base for RMB-gold settlement products. If successful, the Singapore-Malaysia corridor could become a key bridge linking ASEAN trade to China’s broader RMB-gold ecosystem.

Middle East and Africa Route

And then there is the partnership between the Shanghai Gold Exchange (SGE) and Dubai’s commodities hub. The collaboration has introduced a renminbi-denominated “Shanghai Gold” contract on Dubai’s exchange platform. By enabling local and regional traders to settle bullion in China’s currency rather than the U.S. dollar, the contract challenges the long-standing dominance of London’s LBMA and New York’s COMEX price benchmarks. This move strengthens the SGE’s ambition to extend its pricing influence beyond Asia and encourage oil-producing states to integrate RMB-gold instruments into their trade.

One of the more innovative components under pilot testing is a closed-loop oil-RMB-gold trading system. In this model, Middle-Eastern oil exporters—initially focused on Gulf producers—would receive payment for crude in RMB. Instead of converting that RMB back into dollars, they could directly exchange the proceeds for vaulted gold held in local Dubai or Saudi facilities linked to the SGE network. The mechanism is designed to provide both a hedge against dollar volatility and a tangible store of value, enhancing the RMB’s appeal as a settlement currency.

The strategy also extends to Africa, where several Belt-and-Road projects envision “gold-mortgage” financing: countries with significant gold reserves could pledge mined or in-ground gold as collateral to secure infrastructure loans from Chinese lenders. This arrangement would give resource-rich but capital-scarce nations greater access to credit while binding them into the RMB-gold settlement framework.

If these initiatives succeed, they could form what Chinese strategists describe as a “Saudi–Southeast Asia–Africa Golden Corridor.” Such a corridor would link energy exporters, trade hubs, and resource-financed infrastructure projects under a common RMB-gold ecosystem, potentially eroding the dollar’s role in commodity pricing and reshaping the financial landscape of the Global South.

The World is Changing

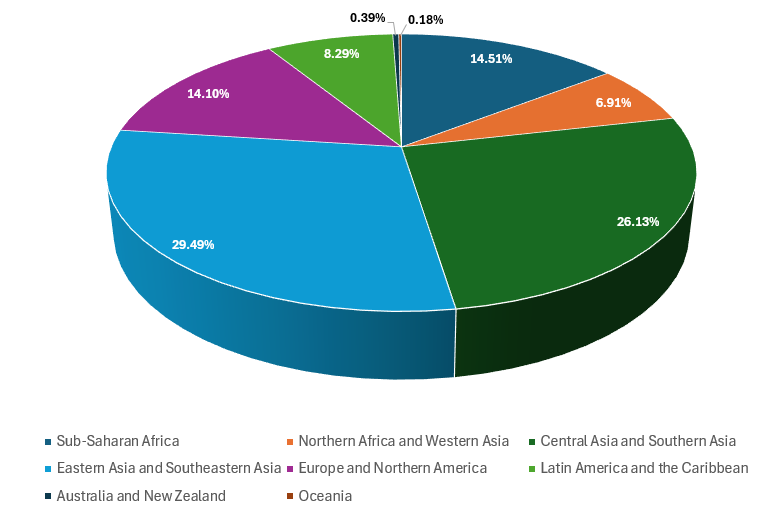

The population distribution by major regions presents a fascinating and sobering realization.

Check the chart below for more information. (Source: World Population - Wikipedia)

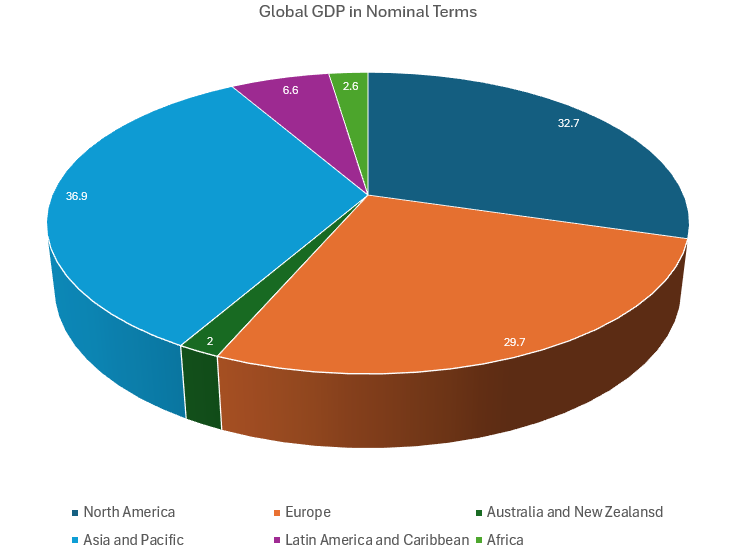

As for the economic front, the tide has definitely turned.

In nominal terms, the percentages look like:

- West: 58%

- Non-West: 42%

The chart below shows the breakup of the different regions. This is based on the figures from Wikipedia.

- List of African countries by GDP (nominal)

- List of Arab League countries by GDP (nominal)

- List of countries in Asia-Pacific by GDP (nominal)

- List of Commonwealth of Nations countries by GDP (nominal)

- List of Latin American and Caribbean countries by GDP (nominal)

- List of North American countries by GDP (nominal)

- List of Oceanian countries by GDP

- List of sovereign states in Europe by GDP (nominal)

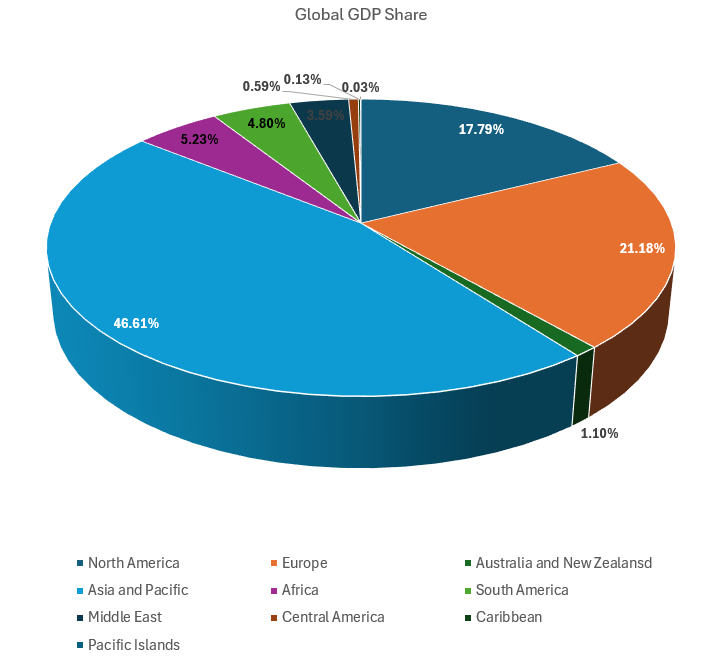

Based on projections for 2025 from the International Monetary Fund (IMF), here is a regional GDP comparison in terms of the percentage share of global GDP, using purchasing power parity (PPP).

The breakup is:

- West (Europe/NA/Australia/NZ): 40%

- Non-West: 60%

So you see an interesting situation here.

The Non-West is emerging from a long era of colonization followed by cultural imperialism. As the populations in the non-Western world rise, while Western populations decline, the world will have more of the former than the latter.

The economic growth shows that their share in the global economy will also grow. As the BRICS has shown, groupings that are essentially non-Western are becoming larger than the Western groupings, such as the G-7.

These fundamentals mean the non-West is no longer a peripheral bloc but already a co-equal. Simply under-represented in the financial and governance architecture built after 1945.

To fully appreciate the change, please watch this extremely engaging and contentious discussion between two Asia and China experts - Kishore Mahbubani, 2023-24 Schlager visiting fellow at the University of Pennsylvania's Perry World House; and Orville Schell, Arthur Ross director of the Asia Society’s Center on U.S.-China Relations.

With that as our background information, let us look at the BRICS Foreign Ministers' meeting in New York.

Open Confrontation?

The External Affairs Minister, Dr. S. Jaishankar, publicly announced that he “hosted a meeting of the BRICS Foreign Ministers in New York” with the messaging that “when multilateralism is under stress, BRICS has stood firm.”

He used the forum to call for UN Security Council reform, critique protectionism, and promote dialogue, diplomacy, peace, and international law.

This is when US President Donald Trump is openly antagonistic towards BRICS.

He has threatened additional tariffs (10%) on countries aligning with “anti-American policies” under the BRICS.

In fact, Trump has publicly derided BRICS, saying e.g. the bloc “would end quickly if they ever formed in a meaningful way.”

There is already a marked tension in the India-US relations due to trade disputes, tariffs, and strategic divergence. There is a diplomatic and trade “crisis” at the moment.

So how do we see it?

- A diplomatic signal affirming India's sovereignty and strategic autonomy, as it resists external pressure or coercion.

- A move to reposition India as an independent player in multilateral settings, not merely a U.S. client.

- A way to frame the narrative: India is not just reacting defensively to U.S. pressure, but proactively championing multilateralism and global governance.

In effect, it is not necessarily intended as an affront, but it functions as one in some interpretive frames. Given Trump’s hostility toward BRICS and his readiness to weaponize trade, the action is inevitably going to be read in confrontational terms by parts of the U.S. political establishment and media.

Look, it isn’t unusual for nations to hold multilateral meetings on foreign soil; diplomacy often unfolds at neutral venues, even in the territory of a global power.

However, in today’s geopolitical climate, hosting BRICS foreign ministers in New York (within the U.S.’s own sphere) carries unusual weight.

The meeting’s tone, which challenges protectionism and highlights strains on multilateralism, lends the gesture symbolic weight.

For India, this move signals a new level of confidence in its international standing.

It underscores New Delhi’s readiness to assert strategic autonomy and push back, albeit subtly, against pressures from dominant powers.

Let's examine the world today to gain a comprehensive understanding of the context.

Geopolitical Landscape

The United States under Donald Trump has re-embraced an overtly protectionist agenda. Tariffs are wielded as the first tool of diplomacy, aimed not just at adversaries but also at allies who resist Washington’s terms. The administration prefers transactional alliances built on immediate quid pro quo rather than long-standing institutional commitments. Multilateral forums—whether the UN, WTO, or even BRICS—are viewed with suspicion or outright hostility, seen as constraints on U.S. leverage. Trump’s team uses America’s enduring currency dominance and control of global finance as bargaining chips, threatening sanctions or withdrawal of dollar access to extract concessions. His polarizing rhetoric further divides the international stage, casting Russia as the prime disruptor of world order while treating China as a systemic, long-term competitor that must be contained economically and technologically.

Europe finds itself in a tricky balancing act. While tied to the U.S. security umbrella through NATO, European governments are increasingly uneasy with Trump’s unpredictable tariffs, extraterritorial sanctions, and demands for higher defense spending. The continent’s leaders, especially in France and Germany, aspire to strategic autonomy, seeking a more independent energy transition, diversified trade routes, and new financial rails that reduce exposure to U.S. secondary sanctions. Yet the economic and defense interdependence with Washington makes a clean break politically risky and economically disruptive, leaving Europe hesitant—caught between aspirations for sovereignty and the practical necessity of U.S. partnership.

Russia, meanwhile, has been re-cast as the central villain in the Western narrative, blamed not only for the war in Ukraine but for destabilizing cyber campaigns, energy manipulation, and broader geopolitical unrest. Western sanctions have largely cut Moscow off from dollar-clearing networks and European markets, forcing the Kremlin to deepen ties with China, India, the Middle East, and parts of Africa. This pivot accelerates Russia’s integration into non-Western economic corridors such as the RMB-gold trade loop and BRICS-linked energy exchanges.

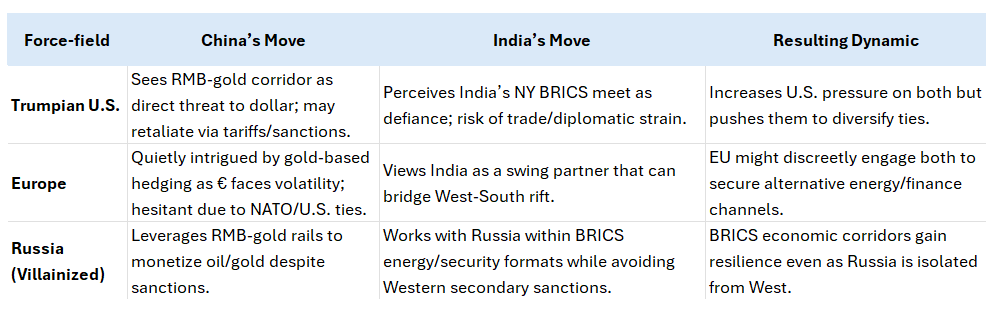

China’s Gold-Vault Strategy and India’s Multilateral Signaling

China’s current financial push aims to build a commodity-backed settlement rail that anchors the renminbi (RMB) as a credible alternative to the dollar. The plan centers on RMB-denominated gold contracts traded on the Shanghai Gold Exchange, paired with a growing network of vaults in Shanghai, Dubai, and, eventually, in resource-rich African partners for physical custody.

Beijing’s design is a closed-loop “Oil → RMB → Gold” circuit: oil producers accept RMB for crude sales, then hedge or store the proceeds in bullion within partner vaults. This route bypasses the dollar and the Western-dominated London and New York bullion markets.

The geopolitical advantage is two-fold. It offers non-Western energy and mineral exporters (Saudi Arabia, Iran, and African miners) an avenue to trade outside the reach of U.S. sanctions and banking restrictions. At the same time, it erodes the dollar’s dominance in oil and metal pricing, which has long been the cornerstone of U.S. global leverage. By tying RMB flows to tangible gold, China adds a hard-asset credibility layer to counter skepticism about its fiat currency and its capital-control regime.

India’s approach contrasts in style but is equally strategic. External Affairs Minister S. Jaishankar’s decision to host the BRICS Foreign Ministers’ meeting in New York (despite President Trump’s hostility toward BRICS) showcased India’s resolve to maintain strategic autonomy.

Through this move, India projected itself as the voice of the Global South, calling for UN Security Council reform and decrying protectionism, positions resonating with the 80 percent of the world’s population outside the Western bloc. At the same time, New Delhi has preserved its security partnerships with the U.S. and the Quad, signaling to BRICS+ members that it seeks reform of the rules and equitable governance rather than bloc confrontation.

Together, these initiatives highlight a shifting order: China is building new financial infrastructure to challenge dollar hegemony. At the same time, India asserts diplomatic independence to shape global norms—both recalibrating power dynamics in a fractured world.

Here is one way to place these two moves within the broader geopolitical context.

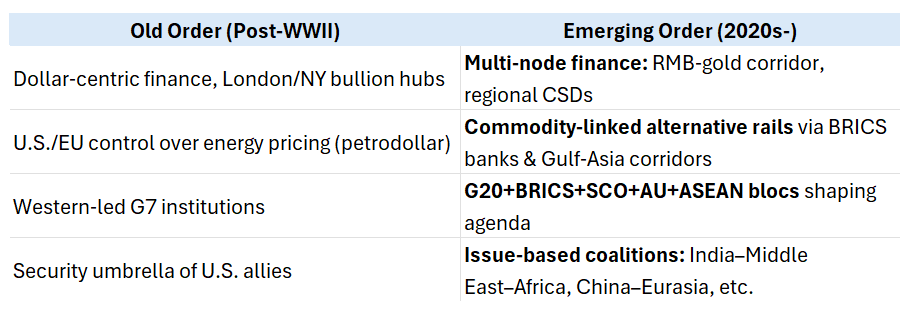

The world’s tectonic plates of power are shifting—that much is evident. But where these plates will finally settle is the larger question. The past eighty years have been shaped by a U.S.-led, dollar-centric “Old Order” that tied finance, trade, and security into Western hubs. That system is now being challenged by an emerging order that is more multipolar, commodity-anchored, and issue-driven.

To understand the change, it helps to define the two eras. The Old Order, established after World War II, centered on dollar-dominated finance through the London and New York bullion markets, U.S.-EU control over energy pricing through the petrodollar, Western-led G7 institutions, and the U.S. security umbrella for its allies.

The Emerging Order of the 2020s onward looks different: multi-node finance like the RMB-gold corridor and regional central-securities depositories; commodity-linked payment rails built by BRICS banks and Gulf-Asia trade corridors; a larger agenda-setting role for G20, BRICS, SCO, AU, and ASEAN; and issue-based coalitions such as India–Middle East–Africa or China–Eurasia that operate outside rigid bloc politics.

This transformation is undeniably disruptive. Yet while the contours of the shift are visible now, the full weight of its consequences, on currencies, trade flows, and security alignments, will take years to unfold.

Or perhaps the entire process could be accelerated by the actions of just a few key players — or triggered suddenly by one or two black-swan events.

A coordinated move by major oil exporters to settle energy sales in non-dollar currencies, for example, could compress what might otherwise have taken a decade into a few months.

A large-scale financial crisis in the U.S. or Europe, a major sanctions shock, or even an unforeseen regional conflict disrupting shipping lanes could likewise force a rapid break from the old system’s norms.

Such unpredictable catalysts often act like geological quakes on these geopolitical “plates”: the underlying shift is already underway, but a jolt can cause it to slip abruptly, reshaping global finance and alliances almost overnight.

This is why watching both structural trends and sudden trigger points is critical to understanding the speed of the coming transition.

Where are the Dark Clouds of Doom?

Global markets appear calm on the surface, yet the structural risks beneath are deepening.

For two years, analysts have warned of a downturn and a geopolitical storm; the reason it still feels distant is that the triggers have not yet coincided.

The world can sense that something is wrong:

- wars simmer,

- debt piles up,

- political tempers flare

Yet daily behaviour suggests it is still living in the relative calm of 2019.

Financial markets embody this paradox. Investors have priced in a “soft landing,” expecting growth to slow gently but not collapse.

These signals convey confidence that central banks will steer the economy through turbulence without causing significant damage.

Clearly, these improvements convey a sense that the crisis cycle has been resolved and that the global economy has regained a stable footing.

But the comfort is deceptive. What is missing today is not risk but pain.

The absence of immediate distress is being misread as structural resilience. Beneath the surface, the fundamental fragilities (record global debt, fragile credit markets, chokepoints at critical sea-lanes, and unresolved political flash-points) continue to accumulate.

They do not appear in quarterly GDP reports or headline unemployment data; they lie latent in the system's infrastructure.

The strategic insight is clear: danger does not always announce itself with falling output or market crashes.

It accumulates quietly in the background infrastructure that keeps trade, energy, and finance moving. Ignoring these deep-seated pressures because headline indicators appear benign leaves governments, businesses, and households vulnerable to sudden shocks.

The world, therefore, needs to shift its gaze from backward-looking statistics to forward-looking stress signals.

Only by watching those undercurrents can leaders recognise that the dark clouds are already forming, even if the sky above still appears calm.

Two Front Storm

The global economy is facing stress on two fronts that rarely peak together.

On the macroeconomic front, years of cheap money have left governments and companies with heavy debt. Central banks are still running tight monetary policy to keep inflation in check, leaving credit spreads fragile and vulnerable to any loss of confidence.

On the geopolitical front, conflicts in Ukraine and Gaza remain active, while flashpoints such as the Taiwan Strait, the Strait of Hormuz, and the Red Sea threaten critical trade routes and energy supplies.

Each front, taken alone, can be managed with targeted policy tools such as rate cuts, liquidity injections, or diplomatic containment.

However, if both fronts flare up simultaneously, the usual stabilizers lose their effectiveness.

Bottomline: It is the synchronous stress (economic fragility colliding with geopolitical escalation) that carries the real risk of tipping the global system into crisis.

Most of the time, we continue to review lagging indicators, such as GDP, unemployment, or loan defaults. All these register distress to the economy only after the damage is done. In such times, the narrative fatigue dulls public reaction. You see, we have been bombarded by years of crisis headlines - the doom is about to hit us!

The Indicators that do matter, such as Red Sea insurance spikes or Baltic freight swings, seem too obscure. They are easy to dismiss, therefore. Until they hit the consumer prices or cause shortages.

Then there is a persistent policy-put bias. The inherent trust that central banks or G-7 leaders will intervene breeds complacency.

The danger lies not in a single shock but in the convergence of energy chokepoints, credit stress, and conflict escalation.

Strategic planning, therefore, demands we shift attention from quarterly GDP to forward indicators that reveal whether the global system can still self-correct — or whether it’s approaching an irreversible slide.

This is why we believe that a carefully crafted forward-indicator dashboard is vital.

That would bring hidden risks to the surface before they explode!

The Tripping Forward Looking Indicators to Watch

Broadly speaking, here are some of the indicators that you may want to follow every week to predict when the real escalation is about to happen.

- Brent front-month (energy shock?); EIA STEO updates (inventory builds?) U.S. Energy Information Administration

- Drewry WCI & Baltic Dry (supply chain pressure?) Drewry

- Global PMI (trend), US/EU/China PMIs (broadening slowdown?) S&P Global

- HY OAS & MOVE (market stress?) FRED

- UNCTAD shipping notes / Red Sea incident tally (persistent reroutes?) Reuters

- Ukraine ISW/Critical Threats daily, Taiwan MND/CSIS trackers (escalation warning?)

However, we have consolidated 12 critical indicators from various sources that can provide an interesting picture.

They have been listed in the sheet below. Think of this sheet like a cockpit.

To make geopolitical future sense of it, let's say if three or more of these trip at the same time, the probability shifts toward a hard downturn or a “no-going-back” geopolitical phase.

The Sum of the Parts

The central strategic question is no longer “Will there be a recession?” but:

Economic slowdowns are usually cyclical. Output contracts, demand softens, central banks cut rates, and recovery follows.

What threatens the system now is a convergence of three shocks that can override these stabilizers and shift the economy into a new, unstable regime.

- Energy Supply Disruption – A sustained spike in oil or gas due to conflict in the Gulf, pipeline sabotage, or chokepoint closure such as Hormuz or the Red Sea. Such shocks raise costs everywhere at once, fuelling inflation while strangling growth.

- Credit-Market Tightening – Higher interest rates and investor risk-aversion that push up borrowing costs. If high-yield spreads blow out or funding markets seize, households and firms cannot absorb higher energy costs, amplifying stress across sectors.

- A Political or Kinetic Trigger – An event that damages confidence: a regional war spreading beyond borders, sanctions that fracture trade routes, or domestic political crises that paralyse policymaking.

Individually, each shock is painful but often manageable. Together, they interact: expensive energy worsens inflation, tight credit denies relief, and political conflict erodes the trust needed for a coordinated response.

This triad converts a cyclical slowdown into a regime shift. A phase where the previous rules no longer work, and recovery cannot follow the usual path.

Comments ()