Dollar-deweaponization, not Dedollarization will erode America's power

Dedollarization has gained importance even as USD still dominates global trade and flows. What BRICS etc are doing is Dollar Deweaponization. Dollar can be everywhere but without the teeth to unilaterally punish others and promote economic colonization.

The Temple of the Golden Bowl

Long ago, in a mountain valley, there was a temple with a single golden bowl. Every monk and traveler who wished to eat had to use that bowl. The abbot declared, “This bowl is the center of the temple. Whoever controls it controls the meal.”

At first, all were grateful. The bowl was sturdy, and it fed the valley. But as years passed, the abbot began to deny food to those who questioned him. “No bowl, no rice,” he said. Hungry and powerless, many submitted. The golden bowl became less a gift, more a weapon.

One day, a wandering monk came with clay bowls. “They are not golden,” he said, “but they can carry rice just the same.” Soon others brought wooden, iron, even stone bowls. The temple still had the golden one, shining in the center. But the people no longer bowed to it.

The abbot looked around. The golden bowl remained — but the power it once commanded had slipped away, like water between his fingers.

SUPPORT DRISHTIKONE

In an increasingly complex and shifting world, thoughtful analysis is rare and essential. At Drishtikone, we dedicate hundreds of dollars and hours each month to producing deep, independent insights on geopolitics, culture, and global trends. Our work is rigorous, fearless, and free from advertising and external influence, sustained solely by the support of readers like you. For over two decades, Drishtikone has remained a one-person labor of commitment: no staff, no corporate funding — just a deep belief in the importance of perspective, truth, and analysis. If our work helps you better understand the forces shaping our world, we invite you to support it with your contribution by subscribing to the paid version or a one-time gift. Your support directly fuels independent thinking. To contribute, choose the USD equivalent amount you are comfortable with in your own currency. You can head to the Contribute page and use Stripe or PayPal to make a contribution.

US Dollar's Precipitous fall against the Bitcoin

Most currencies are anchored to the U.S. dollar, which means their relative strength is often determined by how they interact with the dollar through trade balances, inflation, and monetary policy. This makes it challenging to assess the true value of the dollar independently. Bitcoin is fundamentally different from traditional currencies in several ways.

Unlike fiat currencies, Bitcoin’s supply is permanently capped at 21 million coins, and its issuance is managed by algorithm rather than government discretion. This fixed supply ensures that Bitcoin cannot be devalued through inflationary money-printing—a practice common among central banks and governments. In addition, Bitcoin functions entirely outside the global frameworks used to coordinate and regulate fiat currencies, such as central banks, SWIFT, or the International Monetary Fund. It operates on a decentralized protocol, relying on global consensus rather than any single authority.

Because of these characteristics, Bitcoin is frequently described as “hard money”—a term historically applied to assets like gold, which were regarded as stable stores of value under systems like the gold standard. Bitcoin’s scarcity, independence from political influence, and lack of centralized control position it as a modern digital benchmark for monetary strength, contrasting sharply with fiat currencies whose value can be subject to manipulation and state policy decisions.

So let us start our analysis by looking at the value of US Dollar against the Bitcoin value. It is a shocking graph. The fall of USD against the bit coin has been spectacular. Specifically in the initial few months and years. That was the time of correction it seems.

That trend, however, has continued even in the recent past - albeit on a much smaller value. The fall in last 5 years is just above 90% from its value 5 years back!

Now for a caveat around this.

In 2010, one U.S. dollar could buy about 15 bitcoins. Today, the same dollar purchases only around 0.000086 BTC.

That represents more than a 99.9% collapse in the dollar’s value when measured against Bitcoin. This dramatic shift highlights Bitcoin’s role as a yardstick for fiat debasement.

Unlike dollars, which are constantly expanded through monetary policy and new issuance, Bitcoin is fundamentally scarce, capped at 21 million units. The contrast exposes the structural inflation built into fiat systems: as more dollars are printed, each one commands less value in real terms.

Historically, gold played a similar role—its rise in nominal fiat terms reflected the hidden debasement of paper currencies. Bitcoin now performs that function in the digital era, showing how fragile fiat’s purchasing power can be when measured against a hard, finite asset.

In effect, we can say that Bitcoin charts does reveal the story of systemic currency dilution.

This has interesting implications:

- USD specifically: Still dominant in global trade and reserves, but against “hard assets” (Bitcoin, gold, real estate) it steadily loses ground.

- Other fiat currencies: They lose value even faster, because most are weaker than USD. The global fiat system as a whole is being devalued relative to scarce assets.

- Investor behavior: Increasingly, institutions and individuals hedge with Bitcoin, gold, commodities, and equities to escape fiat debasement.

So what does this signify?

That is significant.

Especially so for those who are for the increasing dedollarization.

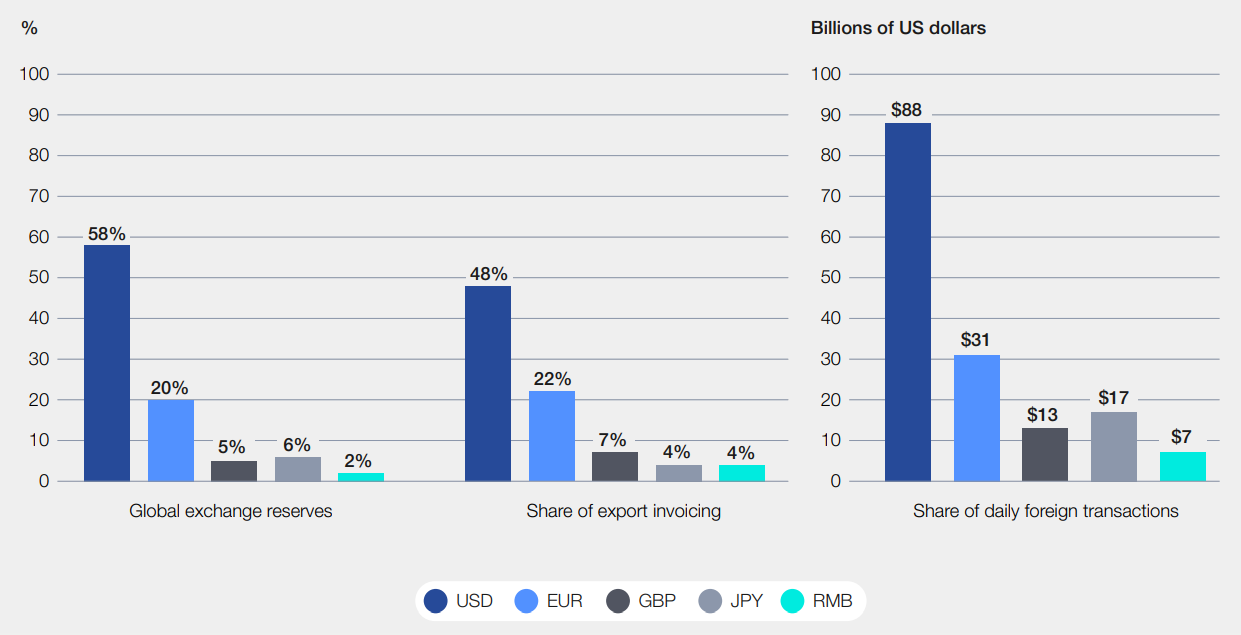

Despite persistent dedollarization discourse, the dollar's position remains formidable across multiple dimensions. As of 2025, the dollar comprises

- 57.7% of global foreign exchange reserves, far exceeding the euro's 20% share.

More striking is its dominance in other critical areas:

- 88% of foreign exchange transaction volume,

- 64% of cross-border debt, and

- 54% of global export invoicing

Here are some charts to show the numbers.

Even after the spectacular fall against the bitcoin, USD remains the foremost currency of choice in the international trade.

That is the reality today.

We cannot, however, escape another truth:

Meanwhile, regional fiat blocs are emerging: the U.S. dollar and G7 currencies on one side, China’s yuan and BRICS partners on the other, each supported by parallel settlement systems.

Continuous money printing, recurring debt crises, and inflation episodes drive investors and nations alike to seek refuge in assets beyond central bank control, reshaping the future of global finance.

This needs to be understood properly.

What might appear as dedollarization at one level, does not show itself in hard statistics. Yet the erosion of trust in USD as a benchmark currency can be seen quite clearly.

The Power of USD as a Geoeconomics Weapon

There is another area that we need to look at. The weaponization of the USD and the its waning impact.

While outright replacement of the dollar is a distant goal, a more immediate development is that many countries are taking concrete steps to bypass the U.S.-centric financial system when needed.

The driving force here is often the desire to inoculate against U.S. sanctions.

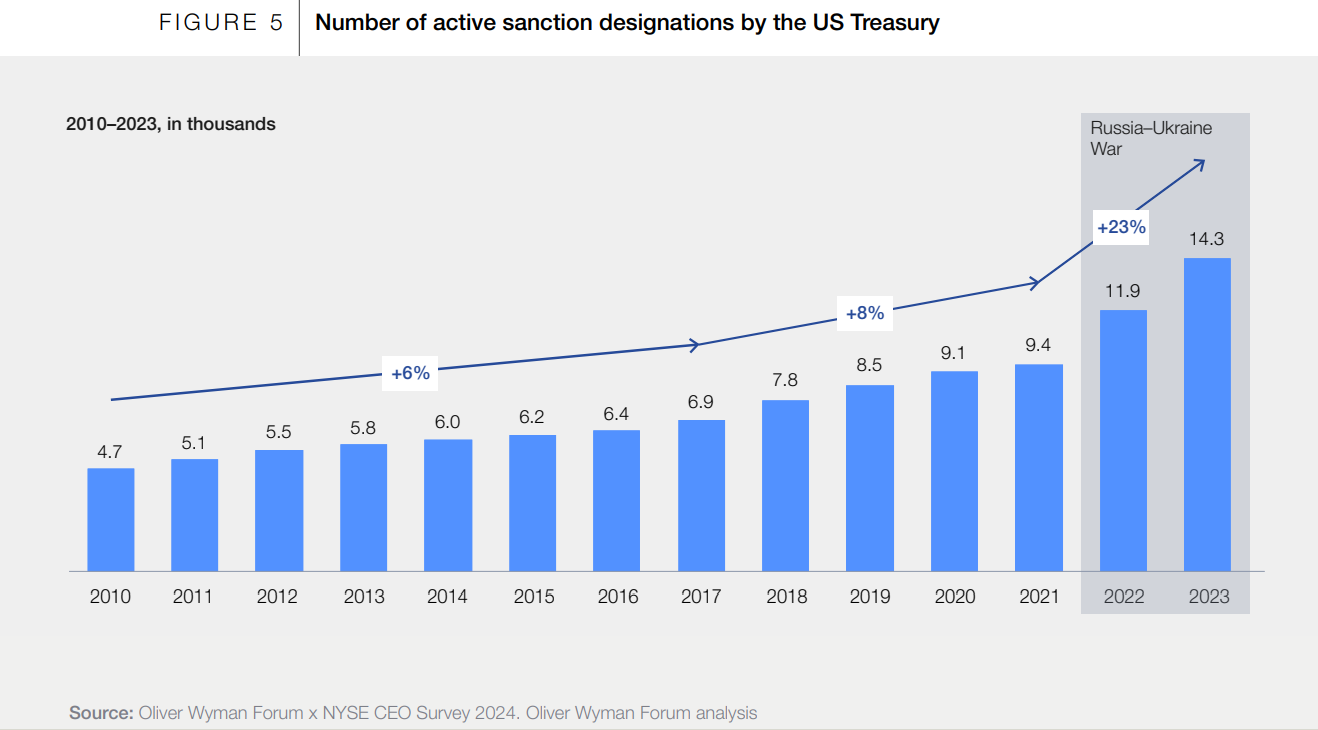

The United States has long enjoyed what economists call the “exorbitant privilege” of issuing the world’s dominant reserve currency. This status allows Washington to fund deficits cheaply and project financial power globally. Over the past decade, however, that privilege has been increasingly weaponized through the aggressive use of economic sanctions. As the graph shows, active U.S. Treasury sanctions designations have nearly tripled, rising from 4,700 in 2010 to over 14,000 in 2023. While sanctions were once deployed selectively, they are now used routinely, with major spikes after geopolitical crises such as Russia’s invasion of Ukraine.

By leveraging its central role in global finance, the U.S. can freeze assets, cut countries off from dollar clearing systems, and exert pressure far beyond its borders.

Yet this very overreach erodes the foundations of the dollar’s dominance. Nations targeted—or merely wary of future coercion—are accelerating efforts to create alternative settlement systems and diversify reserves into gold, commodities, and even digital assets.

American sanctions are so potent largely because of the dollar’s central role: when the U.S. sanctions a target, it can threaten to cut off access to the dollar-based global banking network, which is a crippling prospect for any nation or company.

As of today, about 60% of world reserves are dollars and a huge share of transactions flow through SWIFT and other systems that the U.S. can influence. The U.S. effectively uses the dollar’s dominance as a geopolitical chokehold: foreign banks and firms must comply with U.S. sanctions or risk losing access to U.S. markets and the dollar clearing system.

This is why the Office of Foreign Assets Control (OFAC) and U.S. Treasury sanctions have such global bite.

You see, even allies’ banks have paid billions in fines for sanctions violations. In short, the “weaponization” of the dollar has been a cornerstone of U.S. foreign policy leverage.

Facing this reality, sanctioned states and even some U.S. rivals have been developing alternative channels to reduce their vulnerability. A prime example is Russia.

After heavy sanctions in 2014 (Crimea) and especially 2022 (Ukraine invasion), Russia was partially cut off from dollar financing and even had hundreds of billions in dollar reserves frozen.

In response, Russia dramatically increased trade in other currencies – for instance, settling oil and gas sales in rubles, yuan, or gold instead of USD.

By 2023, China had become Russia’s largest trading partner with much of the bilateral trade conducted in Chinese yuan rather than dollars.

Now Russia has built its own domestic interbank messaging system (SPFS) as a SWIFT alternative after some Russian banks were banned from SWIFT. SPFS now connects hundreds of banks, and Russia has sought to link it with systems in other countries to enable non-dollar trade settlement.

China, for its part, has a long-term strategy to reduce dollar reliance – not necessarily to completely dethrone the USD immediately, but to buffer China from U.S. financial pressure.

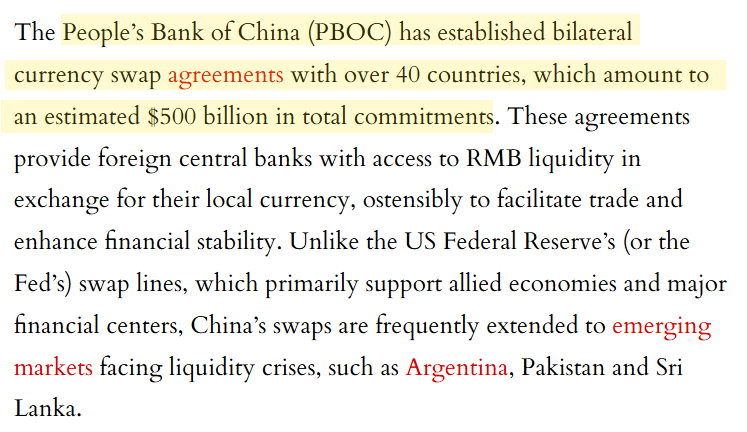

China has established currency swap lines with over 40 countries totaling $500+ billion, allowing those countries to trade with China in yuan and local currencies without using dollars.

It created the Cross-Border Interbank Payment System (CIPS) in 2015, a yuan-based payment network that can function as an alternative to SWIFT for clearing international yuan transactions.

As per the above report, CIPS handled over $12 trillion in transactions in 2022 and has over 1,300 participating financial institutions globally.

The proportion of local currency settlement has increased significantly. With the deepening of financial cooperation between China and Russia, local currency settlement has become increasingly prominent in bilateral economic and trade cooperation, and RMB and Ruble have gradually replaced other currencies as the main settlement methods. According to data, as of 2024, more than 95 percent of the transactions in China-Russia trade had been settled in yuan and rubles, which greatly reduced dependence on third-party currencies. At the same time, the scale of financial cooperation between China and Russia continues to expand. According to data released by the People's Bank of China, by the end of 2024, the scale of swap funds under the Sino-Russian RMB swap agreement had reached 150 billion yuan ($20.86 billion). China and Russia have continued to strengthen the improvement of bilateral financial infrastructure. In the two joint statements in 2023 and 2024, China and Russia emphasized the strengthening of mutually beneficial financial cooperation, the expansion of the use of local currencies in bilateral economic and trade activities, and cooperation to ensure smooth settlement between economic entities of the two countries. The two countries have been actively promoting the alignment of the Chinese Cross-border Interbank Payment Sytem and the Russian System for Transfer of Financial Messages, smoothing the settlement channels for business entities, boosting regulatory financial cooperation and encouraging bilateral investment and bond issuance. (Source: "Monetary cooperation promotes in-depth development of China-Russia economic and trade cooperation" / CGTN)

China also promotes the yuan in trade via initiatives like the Belt and Road – encouraging project loans and contracts in yuan. These moves are gradually building a parallel infrastructure that sidesteps the dollar. While the yuan is still only a small fraction of global reserves, its international use is growing in specific corridors.

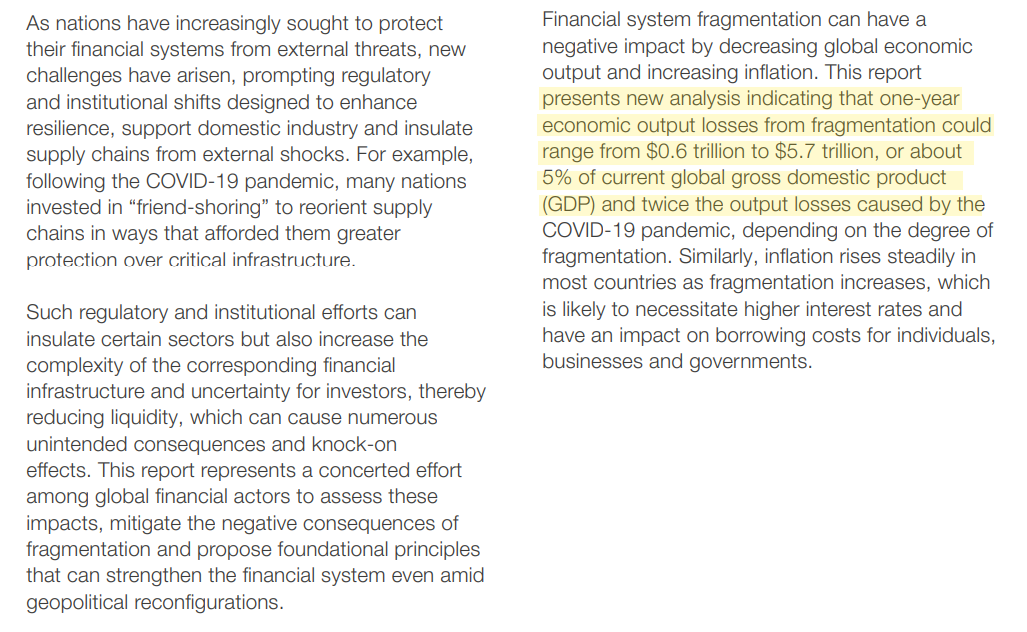

This response from China, Russia and the other BRICS countries, where the Global South increasingly intends to inoculate itself, is being termed by the World Economic Forum as "Financial System Fragmentation."

Per WEF's estimation, the global GDP losses due to this fragmentation could be as high as $5.7 trillion.

Now, when one looks at the scenario dispassionately and objectively - and not from Western hegemonic and exceptionalism standpoint as WEF is prone to do - you find an interesting dichotomy:

That is why several countries are now working on ways to inoculate themselves despite the change in the global GDP in what has been termed as dedollarization.

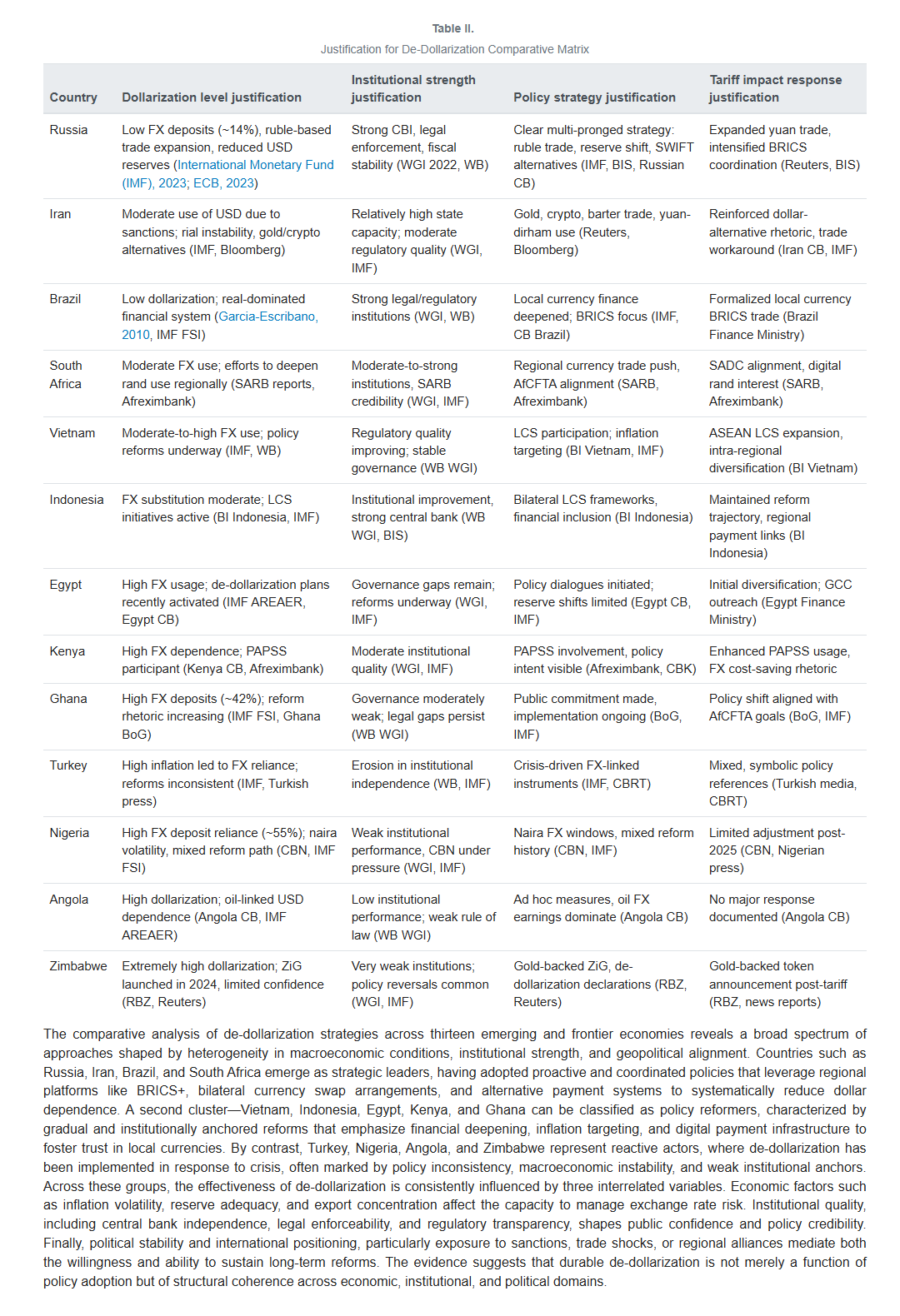

Here is some information from a report in European Journal of Business and Management Research.

Beyond Russia and China, other countries and blocs are also working on mechanisms to trade outside the dollar system.

The BRICS nations (Brazil, Russia, India, China, South Africa, now expanding to include others like Iran and Saudi Arabia) have explicitly put forward ideas to use local currencies or even develop a BRICS currency for trade among themselves.

In 2024, BRICS launched an initiative called “BRICS Pay”, aiming to create a decentralized payments network linking their banks and consumers.

The motivation is clear: after Russia’s exclusion from SWIFT, there is momentum to build an alternative that Western sanctions cannot touch. BRICS Pay “is promoted as a means of ... potentially shielding countries from sanctions imposed by the West”.

Likewise, regional blocs have their own arrangements: for instance, in Southeast Asia, the ASEAN countries have a multilateral swap arrangement (the Chiang Mai Initiative) to support each other’s currencies without IMF/dollar involvement.

In the Middle East, Gulf states like the UAE and Saudi Arabia have explored non-dollar oil trades and even talked with China about using yuan for some energy transactions.

Even U.S. allies have chafed at dollar sanctions: The EU set up a special vehicle called INSTEX to facilitate limited trade with Iran in euros after the U.S. re-imposed sanctions, aiming to bypass U.S. restrictions. Though INSTEX saw limited use and collapsed over time, it did, however, signal Europe’s desire for financial autonomy.

All these measures – currency swaps, alternative payment systems (CIPS, SPFS, BRICS Pay), local-currency trade deals, and digital currencies – can be seen as efforts toward “sanctions-proofing”.

They do not eliminate the dollar overnight, but they create a parallel pathway so that if Washington tries to cut off a country, there is a fallback.

The result is that the effectiveness of U.S. sanctions could wane over time.

Indeed, analysts note that sanctions’ efficacy tends to decline as targets find workarounds; over-broad use of sanctions can even spur the formation of new financial linkages that exclude the U.S. dollar.

We are witnessing exactly this: countries like Russia and Iran, out of necessity, trade in roubles, yuan, gold, or crypto; even countries not under sanctions (India, Brazil, etc.) are experimenting with non-dollar trade with partners to reduce exposure in case they ever face secondary sanctions or political pressure.

Dollar-Deweaponization vs DeDollarization

Even in the face of an overwhelming dominance of USD in trade, forex reserves and as the fiat benchmark, the power of US to weaponize it is underway.

Whenever a country finds a fallback to US sanctions, it has eroded the American power to weaponize the Dollar to hurt itself. When this safety is built into the financial systems for multiple countries as a block, it takes a new direction for the world.

We are looking at Dollar-Deweaponization as opposed to DeDollarization necessarily.

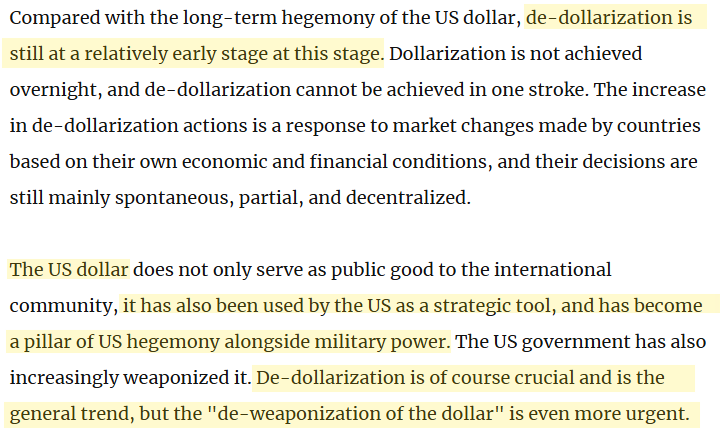

This piece from the Global Times lays how the two related but separate trends are playing out in clear way.

Given this trend of Dollar DeWeaponization, how do we think the scenario will play out going forward?

How will Deweaponization Play out?

Looking forward, the global geopolitical power structure could be significantly reshaped if the economic/financial infrastructure segregates into distinct blocs.

For the last 75 years, we’ve essentially had a unipolar financial order centered on the U.S. (and its allies) – with the dollar as the backbone of global trade, investment, and payments.

That architecture made the U.S. a sort of “global economic gatekeeper.”

If we are now moving towards a world where there are multiple, parallel financial systems – a dollar-centric one and one or more alternative networks – power will become more distributed and contested.

One plausible scenario is a bifurcated global economy: on one side, a U.S./G7-led system (dollar, euro, SWIFT, Western banks); on the other, a China/BRICS-led system (involving increased use of yuan, alternative payment rails, and regional development banks).

In such a scenario, the ability of any one country (even the U.S.) to police global finance is much reduced. Countries might trade and finance within their preferred bloc to avoid scrutiny from the other.

As an International Bar Association analysis noted, BRICS efforts like BRICS Pay “mark a significant step towards a multipolar global economy, reducing the dominance of the US dollar”.

A more multipolar or fragmented international trade profile is likely, essentially splitting into “competing blocs.”

‘The very cohesion of BRICS ultimately favours a more fragmented international trade profile into competing blocs,’ says Monteiro de Carvalho

We are already seeing hints of this: the BRICS bloc’s expansion to include major oil producers (Saudi Arabia, UAE, etc. joining) suggests an intent to challenge Western economic influence collectively. If BRICS and others deepen their intra-bloc trade and financial ties at the expense of inter-bloc ties, globalization could partially recede into more regional circuits. As one expert observed, the cohesion of BRICS in pursuing new systems “ultimately favors a more fragmented international trade profile into competing blocs”.

For the United States and its allies, this fragmentation means losing the “one-network” advantage.

The West may no longer be able to impose universal financial rules or sanctions with the same efficacy. The U.S. will likely remain a top power, but it may have to exercise influence through coalitions and partnerships rather than through automatic dollar supremacy.

We could see the U.S. double down on alliances (e.g. tighter coordination with the EU, Japan, etc.) to preserve a strong allied economic sphere – while nations in the other camp coalesce around China or other regional leaders.

Geopolitically, this resembles a kind of “Cold War” in finance, with parallel systems and reduced interdependence.

However, it’s unlikely to be a complete split – there will still be overlaps and neutral parties.

Even China, for instance, has deep trade ties with the U.S. and Europe that it wouldn’t want to sever. So a likely outcome is a more complex, multipolar economic order where power is balanced among a few major hubs rather than dominated by one.

Crucially, economic leverage will be more diffuse. The U.S. will have a harder time using sanctions to achieve foreign-policy goals unilaterally; it might need broader buy-in (or might resort more to other tools like export controls, technology restrictions, or even military posturing).

Countries that used to fear the wrath of U.S. financial penalties might feel emboldened to defy U.S. preferences if they can trade via alternative channels. We may also see international institutions adapt to this new reality – for example, more regional development banks or payment agreements that operate outside the dollar sphere.

Technological innovations like central bank digital currencies (CBDCs) could accelerate this by enabling direct currency exchanges between countries without touching the traditional correspondent banking system. A Chinese digital yuan used in Africa or Asia via smartphone could bypass both SWIFT and Western banks entirely, making sanctions evasion easier in those transactions.

In sum, as the economic infrastructure segregates, the geopolitical power structure will shift from one anchored by a single currency/system to a more pluralized arrangement.

The U.S. will likely experience a relative loss of its extraordinary financial clout – a loss of the ability to “call the shots” economically – even if the dollar doesn’t disappear.

This doesn’t mean U.S. power collapses overnight; rather, it evolves into one power center among others. The world could become more regionally focused, with perhaps an American/Western sphere and a China/BRICS sphere each with their own financial ecosystems.

Global business and finance would then rest on a dual (or multiple) set of rails, forcing companies and countries to navigate between them.

So, the dedollarization trend in reserves and trade is real but gradual – outright replacement of the dollar is a long way off given its still-high share in global use. More immediate is the trend of countries building workarounds to blunt the impact of U.S. dollar dominance.

Even if the dollar stays top dog in markets, its “weaponization” power is being diluted.

We could term this the loss of U.S. financial coercive power, or simply the “de-weaponization of the dollar”. Over the coming years, if economic infrastructure becomes bifurcated, the result will be a world where no single country can as easily play global economic policeman. The power of SWIFT and dollar sanctions is being challenged and will likely continue to wane as alternative institutions mature.

A more multipolar financial system will emerge – one where economic influence is shared and geopolitical competition plays out across separate financial networks rather than one unified field.

The most accurate characterization of this shift is the transition from "financial hegemony" to "financial primacy" - where the dollar remains dominant but no longer enjoys the monopolistic leverage that enabled comprehensive economic coercion. This represents perhaps the most significant restructuring of international financial architecture since the Bretton Woods system, driven not by market forces alone but by the deliberate construction of "sanctions-resistant infrastructure" by targeted nations.

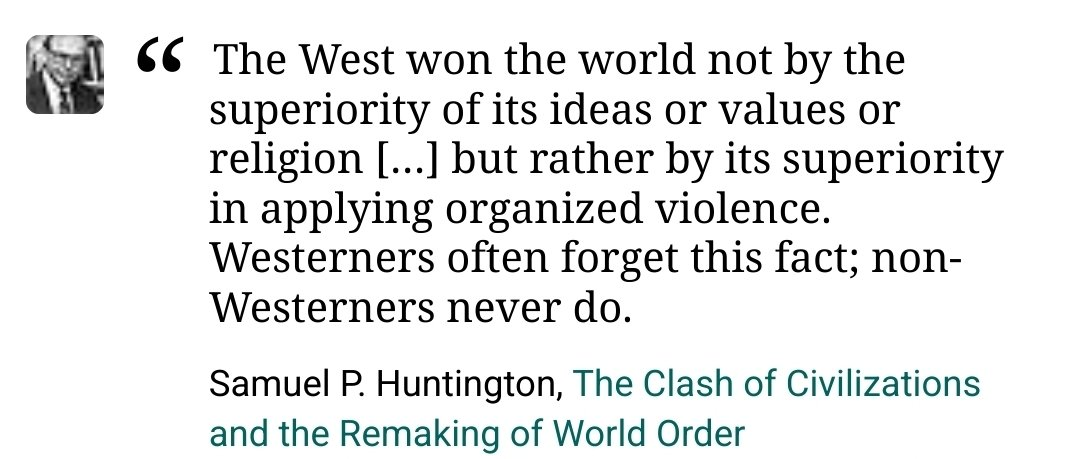

Superiority by Violence: Organized, Epistemic and Financial

Samuel Huntington lays out the truth of Western Exceptionalism in his book "The Clash of Civilizations and the Remaking of World Order" in these words.

Huntington was describing how civilizations interact and why the West dominated global politics in the 19th and 20th centuries.

His point is a corrective to the Western self-image: many Western thinkers like to believe the world accepted Western values (democracy, Christianity, individual liberty) because they were inherently superior.

Huntington counters that what made the West dominant was not persuasion or cultural attraction, but raw military and technological superiority in organized violence.

Huntington defines organized violence as the essence of military power: not just the possession of advanced weapons, but the forged dominance of disciplined armies, unrivaled navies, and the machinery of industrialized warfare.

True superiority lies in the capacity to marshal entire states—bureaucracies, economies, and societies—into a seamless apparatus able to apply force with precision and scale.

But the crucial distinction isn't just technological mastery; it’s the orchestration of violence on a civilizational level. The West’s strength came not merely from armaments, but from the ability to unify state systems and wield violence systematically, reshaping global order.

Where Western societies narrate their ascension as the triumph of values or universal principles, non-Western civilizations hold a vivid, unforgotten memory: the centuries of conquest, colonial domination, and relentless wars by which the West imposed itself. This historical consciousness stands in stark contrast to the West’s selective amnesia. Huntington’s insight illuminates the roots of enduring resentment and conflict—the West decorates its legacy with ideals, while the rest of the world remembers the iron, fire, and disciplined wrath by which it was subjugated.

In his analysis, military power is inseparable from the broader civilizational ability to mobilize, coordinate, and execute violence, and the divergent memories of conquest continue to shape conflict across the globe.

So let us state it clearly yet again.

The "organized violence" is at the civilizational level in every component of social life.

Let us look at the education system to understand this.

You see, the same principle of “weaponization” can be applied not just to military violence but also to civilizational tools of prestige and legitimacy.

- Universities and Academia: Western universities became gatekeepers of “legitimate” knowledge. Their dominance ensured that intellectual capital was certified only if it flowed through Western institutions.

- The Nobel Prize and other awards: These global institutions canonized Western science and ideas as universal, while systematically ignoring or under-recognizing non-Western contributions. (For instance, Jagadish Chandra Bose, S.N. Bose, and even institutions like the IITs/Indian Institute of Science have been marginalized in recognition compared to Western peers.)

- Research Validation Systems: Journals, peer-review networks, and rankings became instruments of control, reinforcing the idea that only Western knowledge “counts” in the global hierarchy.

We have discussed this in more detail in our earlier article.

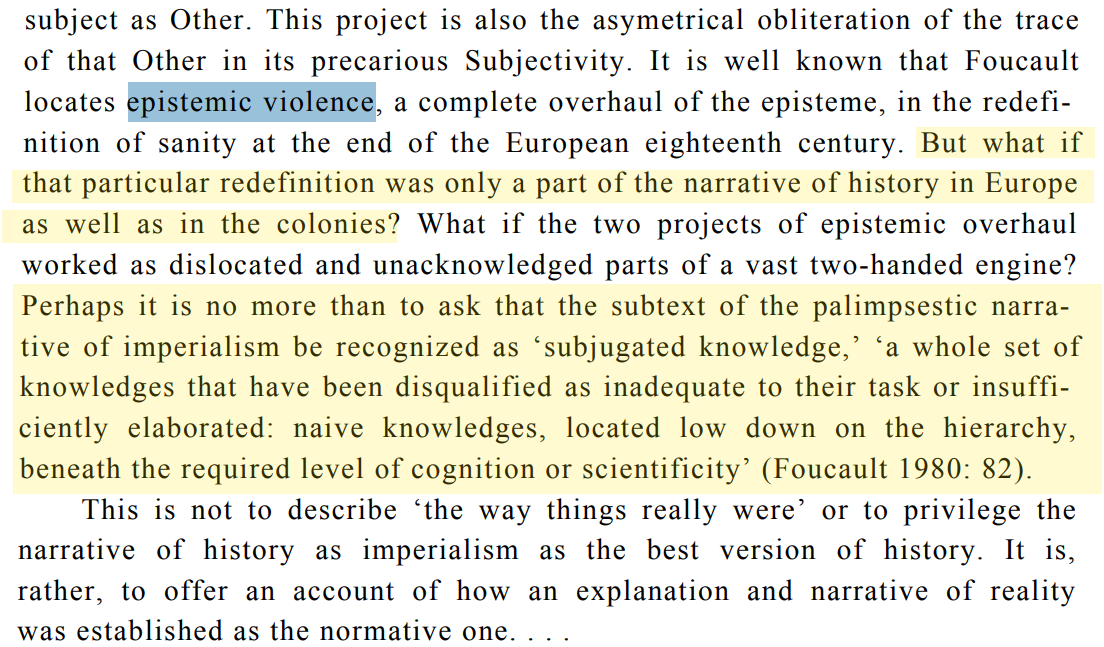

So while Huntington focused on organized physical violence, but what we are looking at is symbolic and epistemic violence—a quieter but enduring form of domination.

- Epistemic Violence (Spivak’s term): By controlling knowledge, the West silenced other traditions.

Epistemic violence is a concept introduced by theorist Gayatri Chakravorty Spivak in her influential 1988 essay Can the Subaltern Speak?

Spivak used the term to describe how marginalized groups are systematically silenced and excluded from knowledge production. This form of violence operates not through physical force but through intellectual and cultural dominance, where the voices of the oppressed are erased, misrepresented, or spoken for by others. By framing their perspectives as illegitimate or invisible, epistemic violence reinforces structures of power and ensures that marginalized communities remain voiceless within dominant discourses of history, politics, and culture.

- Institutional Violence: Rules of funding, recognition, and prestige ensured dependency of non-Western intellectuals on Western validation.

- Civilizational Trauma: This constant deferral to Western legitimacy creates internalized inferiority—what you rightly call “civilizational slavery.”

Let's take Huntington's arguments further.

The West initially asserted dominance through brute force—guns, ships, and armies that subdued vast territories.

Yet sustaining that dominance required more than military conquest; it demanded control over the very frameworks of thought and legitimacy.

Even after political independence, former colonies often found their aspirations, validation, and prestige tethered to Western approval.

This marked a shift from military coercion to civilizational coercion, where power operated not only through armies but through ideas, reputations, and recognition.

What Samuel Huntington once described as “forgetting” by the West and “remembering” by non-Western societies applies here.

Westerners view institutions like elite universities or the Nobel Prize as neutral arenas of meritocracy. In contrast, non-Western societies experience the structural exclusions and biases embedded within them. The result is a system where intellectual authority and cultural legitimacy remain disproportionately concentrated in Western hands, ensuring that colonial hierarchies persist in subtler forms.

Epistemic Violence is the "soft arsenal," if you will.

Huntington’s sentence - superiority in applying organized violence - maps neatly onto this system: coercion without guns, via organized, normalized, routinized power.

What applies to "organized violence" and epistemic violence of Spivak, is no different that what could also (in a similar vein) be called "financial violence."

- Dollar hegemony (“exorbitant privilege”) lets the U.S. externalize deficits, weaponize sanctions, and dictate compliance via SWIFT, correspondent banking, ratings, and Bretton Woods institutions.

- For many states, that experience feels like financial coercion. A "cousin" of epistemic coercion.

Hence, Dollar-Deweaponization, de-dollarization and bloc-building are not merely economic tactics; they are sovereignty projects.

Attempts to diversify away from single-point failure in both knowledge and finance.

That is how we need to see the trends in geoeconomics where the efforts are to lower the impact of Dollar hegemony that fuels the colonizing actions of sanctions.

Comments ()