Predicting 2026 for Economy, US, India and Pakistan

The geo-economic situation around the world is at a precarious state. How will the world go in the coming year. We look at all that.

The Mapmaker and the Lake

A mapmaker came to the monastery carrying a vast scroll.

On it were drawn mountains named Dominion, rivers called Provision, and borders inked with old wars. At the edges, storms were sketched. Some finished, some only hinted.

The mapmaker said to the monk,

“Tell me where the next great fire will start.”

The monk led him to a still lake.

“Throw the map in,” he said.

The mapmaker hesitated. “It took years to draw.”

“Exactly,” said the monk.

The scroll touched the water. Ink bled. Borders dissolved. Mountains became shadows.

The mapmaker cried, “The world is lost!”

The monk replied,

“No. Only your certainty is.”

On the northern shore, two old bears circled each other.

They growled loudly, but their claws stayed half-sheathed.

Each feared the ice would crack beneath a reckless step.

Prediction: The north will roar often, strike rarely, and exhaust itself by guarding every direction at once.

In the east, a dragon practiced formations on the water, measuring distances not to attack—but to be noticed. Across the sea, a tired eagle counted feathers and allies.

Prediction: The eastern winds will carry many drills, few battles,

and long nights where everyone waits for the other to blink.

In the south, a crowded village sat between rivers of belief and memory.

Old wounds were not healed—only covered with rituals. Strangers whispered into the streets, hoping neighbors would fight each other.

Prediction: The greatest danger will not cross borders with flags,

but enter homes as fear, rumor, and rage wearing familiar faces.

Along the forgotten paths, smaller kingdoms learned a quiet art.

They shook slightly, leaned dramatically, and made themselves essential to calm. They were not strong. But they were disruptive.

Prediction: Those who cannot win will still matter, by learning how to interrupt.

Night fell. The lake became a mirror.

The mapmaker looked again and saw something new:

No single fire. Only many small sparks, drifting closer.

He asked, “When does chaos become war?”

The monk placed a pebble in the lake. Ripples touched every shore.

“When people stop believing the water connects them,” he said,

“and think only the pebble matters.”

At dawn, the mapmaker rolled up what remained of his scroll. It was blank.

The monk smiled.

“Now you can see,” he said. “The future is not written in borders or weapons. It is written in attention, patience, and restraint.”

As the mapmaker left, the lake stayed still - but the wind had begun to change.

And those who listened carefully could hear not war, but tests.

SUPPORT DRISHTIKONE

In an increasingly complex and shifting world, thoughtful analysis is rare and essential. At Drishtikone, we dedicate hundreds of dollars and hours each month to producing deep, independent insights on geopolitics, culture, and global trends. Our work is rigorous, fearless, and free from advertising and external influence, sustained solely by the support of readers like you. For over two decades, Drishtikone has remained a one-person labor of commitment: no staff, no corporate funding — just a deep belief in the importance of perspective, truth, and analysis. If our work helps you better understand the forces shaping our world, we invite you to support it with your contribution by subscribing to the paid version or a one-time gift. Your support directly fuels independent thinking. To contribute, choose the USD equivalent amount you are comfortable with in your own currency. You can head to the Contribute page and use Stripe or PayPal to make a contribution.

Predicting 2026

On Drishtikone, at the end of every year until some years back, when we would predict the future year in terms of socio-economic scenarios unfolding in the US, India, and Pakistan.

We want to revive that tradition.

This year, we will start by understanding the current macroeconomic situation and what it could mean for the economy as a whole.

Anomalous Economic Shifts?

Wars are not just fought with missiles. In fact, most wars in the coming years will be fought through levers such as debt, supply chains, and domestic fatigue.

The US and the world are witnessing a paradoxical economic scenario unfold. In the typical scenario:

- Higher interest rates make bonds more attractive as an investment. That leads to money moving out of gold and other risk assets.

- A strong dollar is a sign of a stronger currency and less inflation. This causes the Gold prices to weaken.

- As the yields rise, capital concentrates in lesser investment areas not spread everywhere.

But what do we see today?

US 10-year yields, the dollar index, gold and major equity indices are all elevated into late December 2025, while Bitcoin has stalled below prior highs and underperformed hard assets and equities.

US Treasury yields

- The 10‑year US Treasury yield is around 4.14–4.19% in late December 2025, up about 0.15 percentage points over the last month, as markets reassess how quickly the Fed can ease.

- This level is high versus the post‑GFC and QE norms, even if below the 2023 spike, indicating investors are demanding higher compensation to hold long‑dated US debt.

Gold

- Gold has surged to a record above 4,500 USD/oz; one data series shows gold at around 4,532 USD/oz on 26 December, up about 9% in a month and roughly 73% over 12 months.

- Multiple reports describe 2025 as gold’s best year since the late 1970s, with prices breaking psychological levels near 4,500 USD/oz on safe‑haven demand, fiscal and geopolitical stress, and rate‑cut expectations.

US equities (rising “in pockets”)

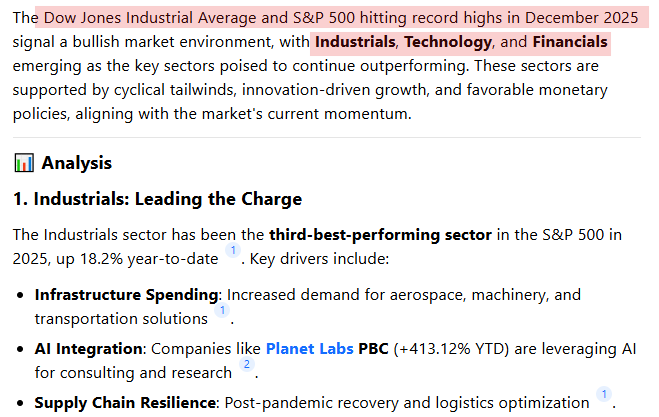

- S&P 500 is up about 16–17% year‑to‑date by early December and still around +17% with only a few trading days left in the year, with all 11 sectors positive and leadership in communication services, tech, and financials

- The rally has broadened beyond the mega‑cap AI names, with cyclicals such as financials, materials, and industrials joining. At the same time, small‑caps and specific sectors have been more volatile, matching your “rising in pockets” characterization.

Bitcoin

- Spot Bitcoin is trading in a compressed range roughly 86,700–88,200 USD in the Christmas week, frequently quoted near 88,000–89,000 USD, below earlier 2025 peaks.

Bitcoin traded near $88,800 on Monday as global markets leaned back into risk following record highs in gold and gains across Asian equities. Ether climbed back above $3,000, while XRP, Solana and Dogecoin also edged higher after a volatile stretch that saw crypto prices swing sharply independent of stocks and commodities. The steadier tone came as gold pushed to an all-time high above $4,380 an ounce, driven by growing bets that the Federal Reserve will deliver additional rate cuts in 2026. The metal is on track for its strongest annual performance since 1979, supported by central-bank buying and persistent inflows into gold-backed exchange-traded funds. (Source: "Bitcoin steadies near $89,000 as gold hits record and Asia stocks rise" / Yahoo Finance)

- So, while gold is up around 70% and silver over 140% in 2025, Bitcoin is down more than 30% from its mid‑year high and has significantly underperformed hard‑asset peers

US Dollar

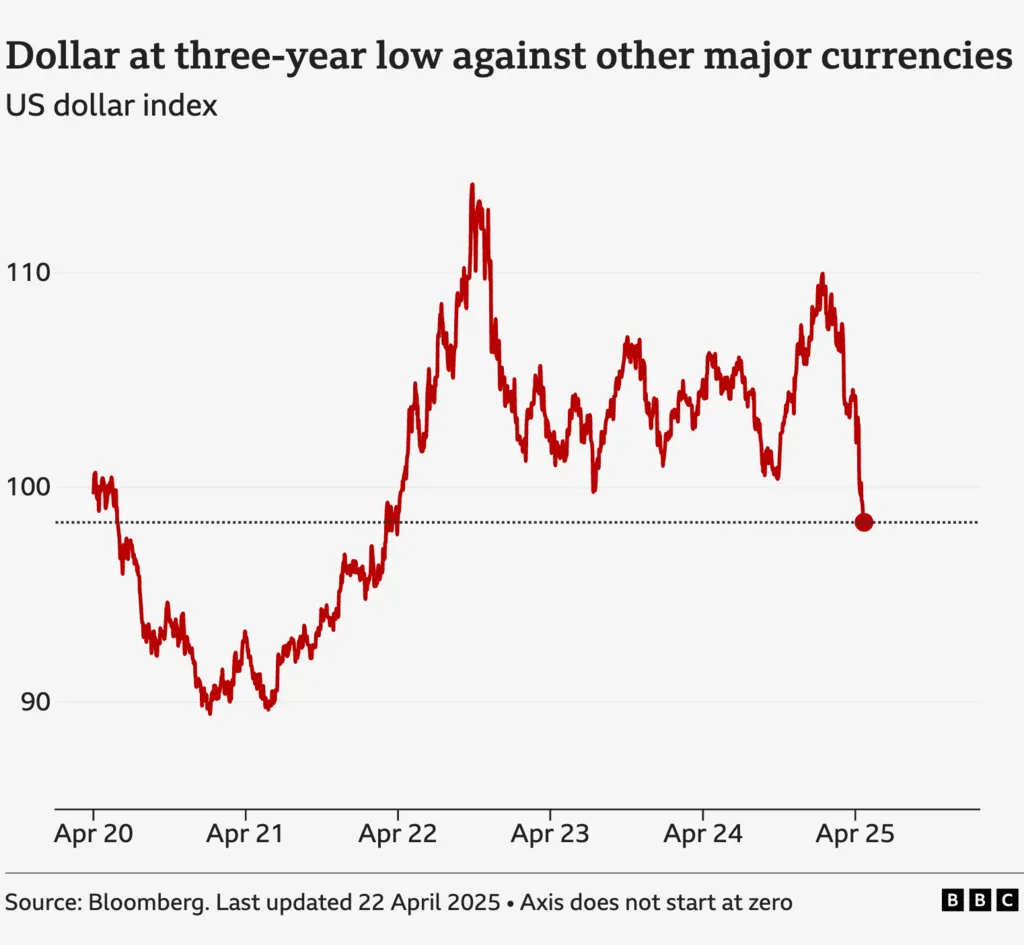

- DXY's performance has been choppy this year.

- We have seen mixed trends in late 2025, generally weakening for much of the year due to fiscal concerns, policy uncertainty (like potential tariffs and loose fiscal policy), and slowing growth expectations, leading to its weakest performance in years despite a slight rebound in the second half.

- At the same time, markets are increasingly pricing in Federal Reserve rate cuts in 2026, reducing expectations of sustained monetary tightness. Relative U.S. growth optimism has also cooled compared to the 2023–24 period, as economic momentum moderates and global alternatives narrow the gap.

So the US Dollar is obviously going through a weakening. Right?

Well, let us look at US Dollar as two different functions and analyze it like that.

Let's call those - The "Market Dollar" and the "System Dollar."

Market Dollar that we see on the FX screens - DXY - can be seen as one that

- Trades vs EUR, JPY, GBP

- Reflects rate differentials, fiscal noise, and political headlines

- This dollar can be weak, sideways, or volatile

System Dollar - that is used for funding, settlements and handling debt. What does that do?

It is used to service:

- $13T+ in non-US dollar debt

- Trade invoicing

- Collateral chains

- This dollar must be owned, regardless of belief

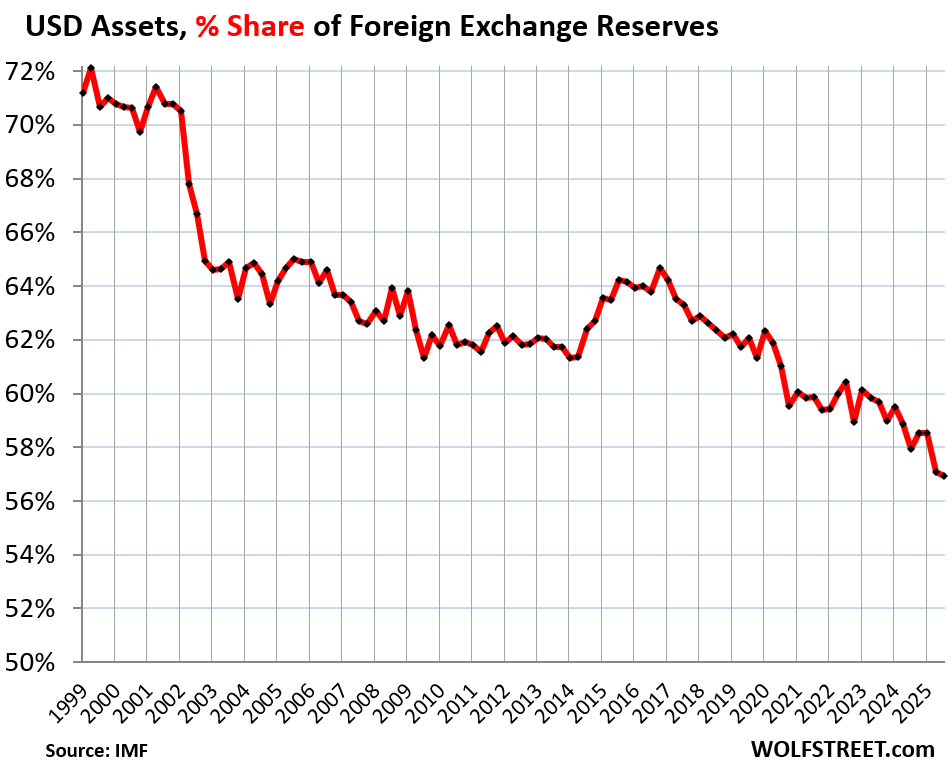

Over the years, the share of USD-denominated assets with other central banks has dropped to 56.1% of the total forex reserves in Q3 2025. This is said to be the lowest since 1994, according to the IMF’s new data on the Currency Composition of Official Foreign Exchange Reserves.

The scenario with respect to the US Dollar we see has been stated as below:

It’s not that foreign central banks dumped US-dollar-denominated assets, such as Treasury securities. They did not. They added a little to their holdings. But they added more assets denominated in other currencies, particularly a gaggle of smaller currencies whose combined share has surged, while central banks’ holdings of USD-denominated assets haven’t changed much for a decade, and so the percentage share of those USD assets continued to decline. As the dollar’s share declines toward the 50% line, the dollar would still be by far the largest reserve currency, as all other currencies combined would weigh as much as the dollar. But it does have consequences. (Source: Status of the US Dollar as Global Reserve Currency: USD Share Drops to Lowest since 1994 / Wolfstreet)

What does this mean?

When the U.S. dollar commanded a 65-7-% share of the global reserves, foreign central banks absorbed U.S. Treasury issuance almost automatically. They were largely indifferent to yield and acted as passive buyers. As the share approaches 50%, Treasury markets increasingly depend on genuine price discovery. Yield sensitivity has risen, auctions face greater scrutiny, and debt servicing costs are becoming both fiscally and politically painful.

The consequence is structural in this case as opposed to being cyclical: higher average interest rates over time, greater volatility across bond markets, and a sharply reduced ability for policymakers to indulge in deficit-driven fiscal fantasies without immediate market discipline.

In this kind of market, Gold becomes a reserve equalizer and not necessarily a hedge. The Central Banks around the world are avoiding large exposures to Yuan or Euro, adding the smaller currencies tactically. We saw the arrangements that Russia is working out with India in terms of reinvestment of INR back into the Indian economy to get returns.

Reserves of the Central Banks show some interesting trends as a bunch of smaller currencies are gaining share.

- Reserves are becoming more fragmented

- Liquidity is getting thinner

- Crisis behavior is becoming less predictable

So what does this lead to?

- FX volatility increases

- Regional stress spreads faster

- More bilateral swaps, fewer universal solutions

Does this make the system stable? No. But it does make it more decentralized.

For US geo-economic dominance, it means that even though the sanctions may work, they will become less effective and less decisive.

- Countries can reroute settlements

- Use regional currencies + gold

- Delay, dilute, or evade pressure

Sanctions will become costlier, slower to impact and more politically debated and contested.

The U.S. must now actively manage confidence, safeguard Treasury market liquidity, and tightly coordinate policy messaging. What was once automatic trust can no longer be assumed. Confidence in the system has shifted from being implicit and guaranteed to explicitly conditional.

“Exorbitant privilege” has now become “exorbitant management” for the US.

Changing World?

Let us, at the outset, lay out an interesting heuristic:

Let us evaluate.

Late 1970s (post‑Bretton Woods, stagflation): After the end of Bretton Woods in 1971, gold rose from roughly 35 USD/oz to over 800 USD/oz by 1980 amid high inflation, oil shocks, and monetary disorder. 2‑year and 10‑year Treasury yields surged into double digits at the same time, signaling a clear episode in which gold and yields rose together during a major shift in the monetary regime under Volcker.

Early 2000s (post‑dotcom, pre‑Iraq): Between roughly 2001 and 2006, gold began a secular bull move (from ~270–300 USD/oz toward ~600+), while the Fed hiked rates from 1% to 5.25% and short‑dated Treasury yields rose. This period preceded the “Great Moderation” peak in terms of belief in US financial engineering rather than an immediate systemic crisis. Still, it marked the start of a long gold bull market, driven by rising leverage and US deficits.

Economists have traditionally attributed the Great Moderation to improvements in macroeconomic policy frameworks, particularly rule-based monetary policy, inflation targeting, and disciplined central bank credibility. Policy tools such as the Taylor rule are often cited as anchoring expectations and dampening shocks. However, alternative interpretations argue that structural and technological changes, such as better inventory management, globalization, and information technology, also played an important role in reducing economic volatility during this period.

2007 (pre‑GFC): In 2005–2007, gold continued to trend up as housing and credit excesses built, but 10‑year Treasury yields were not exploding higher; they peaked around mid‑2006 and then began falling as the crisis approached.

Gold’s very strong performance came during and after the GFC (Global Financial Crisis, the 2007–2009 meltdown in the global banking and credit system centered on US housing, mortgage‑backed securities, and the collapse of major financial institutions like Lehman Brothers), in the context of QE (Quantitative Easing - unconventional central bank policies) and negative real yields, not just before it; the “combo” is less clean here as a pre‑signal.

2020 (pre‑COVID and liquidity blowout): In late 2019/early 2020, gold was rising alongside growing concern about late‑cycle leverage and Fed repo interventions, but Treasury yields were already trending lower as growth fears mounted, then collapsed during the COVID shock.

The real regime shift was the move to near‑zero rates and massive QE after March 2020, where gold rallied strongly as real yields fell deeply negative, consistent with standard gold–real‑yield dynamics rather than a “yields up + gold up” combo.

So what we have is that the late‑1970s example fits the narrative best; the early‑2000s somewhat; 2007 and 2020 are more ambiguous.

Over 1970–2020, the correlation between Treasury Returns and Gold prices is close to zero. There have, however, been brief subperiods when gold and yields moved together.

Analysis from J.P. Morgan and others suggests that the clearest and most concrete manifestation of de-dollarization in reserve management is this turn toward gold. For many emerging-market central banks, gold is viewed as a neutral, non-sovereign store of value and a deliberate alternative to holding reserves in heavily indebted fiat currencies and in U.S. dollar–denominated instruments that carry growing sanction and jurisdictional risks.

Are we in a 2008-style situation?

A 2008-style system-wide bank run is unlikely in the current environment, but selective bank stress and localized deposit runs are very possible. The failure mode today is different.

In 2008, banks collapsed because they held opaque, highly leveraged mortgage assets and lost interbank trust overnight. That created a sudden solvency crisis and a complete funding freeze. Today, banks are not drowning in toxic assets; instead, they face duration risk, margin pressure, and deposit instability. Long-dated bonds bought at low rates are underwater, funding costs are rising, and large uninsured deposits are more mobile and sensitive to confidence.

Several stabilizers reduce the risk of systemic panic: central banks are pre-positioned to backstop liquidity, deposit insurance remains credible for households, problems surface earlier due to transparency, and markets distinguish between liquidity stress and insolvency. These factors prevent a generalized run.

The real risk lies with specific institutions, especially regional or mid-size banks with concentrated customer bases, high uninsured deposits, commercial real-estate exposure, or significant bond mismatches. These banks can see rapid deposit flight even if technically solvent.

Rather than a domino-style collapse, stress will spread through credit tightening, reduced lending, and slower economic activity. This is a slow, managed crisis, not an explosive one — painful, prolonged, and quietly restrictive rather than dramatic.

Having said that, we did see a mini-collapse with Credit Suisse in March 2023 and with Silicon Valley Bank.

So, a cluster of failures, policy mistakes, or a major cyber or geopolitical shock could still produce systemic stress and modern, fast‑moving runs, especially at smaller or specialized banks.

What the Credit Suisse and SVB collapses suggest is that bank runs are now digital, fast, and confidence-driven, and authorities will usually try to ring-fence rather than let contagion spread

Could a liquidity crisis hit? Yes.

If a significant geopolitical or other shock occurs, it could impact the economy in four important ways:

Funding: Stress in short-term funding markets causes repo spreads to spike, wholesale liquidity to evaporate, and bank credit default swaps to widen sharply, signaling rising counterparty risk and eroding confidence among dealers, money markets, and institutional lenders.

Deposit: Uninsured deposits rapidly flee banks perceived as weak or even rumored to be stressed, driven by digital banking and social amplification, turning localized concerns into system-wide liquidity pressures within hours rather than days.

Collateral: Elevated Treasury volatility triggers margin calls across leveraged positions, forcing asset sales into falling markets, amplifying price swings and undermining the assumption that Treasuries function as consistently stable collateral.

Credit: Banks respond defensively by withdrawing or tightening credit lines, causing funding breaks for small and medium enterprises, commercial real estate borrowers, and refinancing-dependent sectors, feeding back into slower growth and rising defaults.

Let us ask ourselves: what could a major geo-economic shock and a market run lead to?

Prediction: Stablecoin Normalization event

If there is a major geo-economic shock that creates a larger Credit Suisse and SVB type collapse the administration will work to ring fence it.

However, another significant movement could impact the economy in its wake.

Stablecoins could get normalized as a parallel payment rail. Not really, yet, as a compulsory replacement for cash, but in these ways:

- Payroll providers, merchants, remittances, brokers, and banks may integrate regulated stablecoins

- The government could encourage stablecoin use for settlement efficiency

- Remember that replacing physical cash quickly would create enormous backlash and operational risk

Could there be a "cinematic collapse" of the currency or the economy and establishment of a digital currency or stablecoin primacy overnight? No.

The real power shift is not in the token (stablecoin vs USD), but in the rules around access, movement, and permissioning.

Step 1: Emergency Normalization of “Regulated Wallets”: After bank stress, authorities frame stability around “trusted digital settlement,” “resilient payment rails,” and “illicit-flow prevention.”

Regulated, KYC-verified wallets are positioned as safer access points to money, not as new currency. Payroll, large transfers, bank conversions, and merchant acceptance increasingly require these wallets. Self-custody wallets are not banned, but they lose interoperability with banks and institutions. This indirect pressure shifts most economic activity into regulated channels while preserving political and legal plausibility. The migration appears voluntary, but the choice architecture is carefully constrained.

Step 2: Transaction Controls Become Policy Tools: Once wallets fall under the purview of regulated intermediaries, transaction controls scale rapidly. Banks and fintechs can enforce transfer caps, geographic restrictions, asset-conversion limits, and review delays under existing AML, sanctions, and emergency authorities.

Stablecoins could enable faster, cheaper, and more uniform enforcement without creating new power.

Controls will feel administrative rather than punitive, framed as prudential risk management. The system could remain formally open, but functionally conditional, allowing policymakers to modulate liquidity and behavior without overt restrictions or new legislation.

Step 3: Freezes Are Targeted, Not Universal: Universal freezes are unnecessary and politically dangerous. Modern control relies on selective restrictions based on account type, transaction patterns, jurisdiction, or counterparty risk. Most users experience continuity, which suppresses panic; a minority face limits or freezes labeled as compliance reviews. From the state’s perspective, this is risk containment, not punishment.

Targeted actions preserve trust in the system while discouraging destabilizing behavior. The absence of visible mass repression is itself a stabilizing feature, making selective control more effective and defensible.

Step 4: Programmability Without Saying “Programmable Money”: Control does not require explicitly programmable currency. It emerges through compliance layers, API permissions, issuer policies, and banking regulations.

If settlement can be denied, conversion delayed, or liquidity access restricted, money is functionally programmable. Stablecoins centralize these enforcement points without ideological framing.

The “leash” is institutional, not technical, embedded in licensing and compliance. This avoids dystopian optics while achieving fine-grained control over monetary flows through routine administrative mechanisms.

Control by another means: This model operates within existing AML/KYC and sanctions frameworks, delegating enforcement to private firms. It is framed as consumer protection and system stability, rather than as explicit bans or seizures.

Rights remain intact on paper while access becomes conditional in practice. Courts and legislatures are less likely to resist because no single dramatic threshold is crossed. Governance power is normalized through procedure, not proclamation.

Now, let us move to the geopolitical scenarios.

Analyzing the Indian Subcontinent

Let us start with the Indian sub-continent.

Pakistan: sits across corridors to Afghanistan/Central Asia and the Arabian Sea, and offers proximity for intelligence and logistics games. Its relationship with China is institutionalized through CPEC (regardless of the success around it) and most importantly as a lever and a proxy against India.

Bangladesh: is the critical “hinge” around India’s Northeast and Bay of Bengal connectivity. In a pressure campaign - like the one Bangladesh's current Hindu-hate attacks are working to incite - war with a proxy like Dhaka is not the answer. A stake in the ongoing intelligence wars and battles within Bangladesh is the way to go.

Sri Lanka / Maldives: leverage is maritime—ports, basing permissions, ISR access, and “denial bubbles.” Sri Lanka’s fiscal bind makes it perpetually open to bargaining with creditors and partners.

Nepal: leverage is political—space for narratives, intelligence movement, and cross-border pressure points (less “military,” more “friction”).

Now we will go deeper.

Pakistan: Subverted Society as the Marketing tool

Pakistan’s core lever has historically been deniable militant infrastructure and cross-border infiltration risk—this doesn’t require a strong economy; it requires:

- permissive terrain,

- institutional protection,

- and plausible deniability.

That’s why Pakistan remains “relevant” even when bankrupt. Why?

Well, because it sells risk management and subversion of India as a package.

For the US and the West, conditional finance becomes a potent geostrategic lever in Pakistan and beyond. After all, Pakistan’s repeated IMF cycles create dependence and also keep it plugged into Western financial diplomacy.

With Sri Lanka also, for example, its restructuring shows how creditors (official and private) were working to shape its policy space. India and China both had to provide financing assurances in the IMF-linked process to have some say.

Many analysts make the mistake of thinking that these countries - say like Pakistan - have some kind of "love-hate" relationship.

Diplomacy and statecraft don't work like that.

That is how time and again, Pakistan's imminent economic collapse is averted by the West.

Pakistan stays “available” as a lever for both China and selective U.S. engagement. It is a society on sale for anti-India work. That makes it relevant.

We need to remember that small states like Pakistan cannot defeat India. Their utility lies in raising the cost of stability, fragmenting attention, and creating deniability.

Let us look at the different levers that Pakistan uses and possible India response options.

Friction without Conflagration

Chaos is the new currency of modern geopolitics. That is what India needs to contend with.

India’s rise threatens no one existentially. However, it compresses space for leverage over it.

The response has not been frontal opposition, but peripheral agitation:

- Maritime signaling in the Indian Ocean

- Political turbulence in neighboring states

- Terror Attacks and subversion

- Narrative pressure through international forums

- Deniable security friction

None of this is designed to defeat India. It is intended to delay consolidation and growth.

And delay is valuable for the forces that want control over India and would like to stall India's progress.

Remember: Every year India spends stabilizing its periphery is a year not spent projecting power outward. That is the leverage.

The emerging order favors states that can disrupt cheaply over those that must endure expensively.

Why? Because -

- Weak states disrupt

- Strong states absorb

- Middle powers stabilize

This asymmetry explains why global politics today is greatly unbalanced.

So, in today’s geopolitical economy:

That is a structural comment on the geo-political mindset today.

Prediction for Pakistan in 2026

In the coming year, looking at the socio-economic situation within the country, one may see :

A rapid collapse or rupture inside Pakistan’s ruling equilibrium.

Could be civil–military split with Imran Khan and his followers being the main cause.

There could also be a leadership removal in terms of uprising within the military against Asim Munir.

And there will be mass unrest. That will force emergency rule and/or a kinetic war with Afghanistan, Balochistan or India.

As all this leads to a sudden loss of central control, powers aligned with it and the ones they target (like India) will be forced to retaliate.

China, the Gulf states, and the U.S. will play their part in stabilizing whatever remains of India's response.

India: Cusp of Greatness and Attacks

The following 3 years will decide India's future for at least the next 200 years.

Next year will be primarily defined by the process, narratives and the debates that go along with the state elections in at least four crucial states - Assam, Kerala, Tamil Nadu and West Bengal.

Coming elections

- Assam Legislative Assembly: All 126 seats are up for election in 2026 as the current assembly’s five-year term ends.

- Kerala Legislative Assembly: All 140 seats are expected to go to polls in 2026 after the term ends.

- Tamil Nadu Legislative Assembly: Elections for all 234 seats are scheduled in April–May 2026.

- West Bengal Legislative Assembly: All 294 seats are expected to be contested in March–April 2026.

- Puducherry (Union Territory) Legislative Assembly: The 30-seat assembly election is also due in 2026.

Hindu resurgence due to opposition-led hate campaigns

One of the most significant changes in India in the recent years has been a political and even more importantly, a geo-political awakening. That keeps people grounded and informed more than they ever were.

Actions like the ones below have crossed the tolerance threshold.

- Sabarimala (loot, opacity, suppression)

- Temple control narratives

- Open derision of Hindu symbols (TN, Kerala and WB)

- Selective enforcement + appeasement (WB, Kerala)

Let us start with West Bengal first.

West Bengal - Beyond an Election: The West Bengal state assembly election will not just be about an election. Bengal is adjacent to Bangladesh, where anti-India games and the consequent threat to the Chicken's Neck are at their peak.

WB connects with:

- Sikkim

- Assam

- Arunachal

- Meghalaya

- Tripura

- Mizoram

Any instability in Bengal translates into existential vulnerability for the entire country!

Once national security fuses with civilizational identity, Bengal becomes different from TN/Kerala.

We need to remember that the missing variable in 2021 was a credible and impactful Bengali Hindu Face. BJP’s core failure in WB so far was not ideology, it was representation.

Mithun Chakraborty?

After the Bengal Files, Mithun Chakraborty had become a significant figure in Bengali public discourse.

Here are two videos, where he is campaigning against TMC and for BJP.

Here he says: "Won't allow TMC to turn West Bengal into 'West Bangladesh'. I am requesting Hindus in Communist party and Congress to join hands with us. We will not alive it till the last drop of blood in our body."

In another video, he says:

"Sanatanis are uniting. We should proudly say- We are Sanatanis."

He is tapping into the biggest issue faced in Bengal today - attacks on Hindus and the voters of the BJP.

Impact of Special Intensive Revision (SIR)

Approximately 58,08,202 names were deleted from the West Bengal voter rolls as part of the Special Intensive Revision (SIR). These include dead, duplicate, permanently shifted, absent, and other uncollectable registrations identified during the process.

So the total number of names struck off — not just in one constituency but statewide — is around 58 lakh (≈ 5.8 million).

On pure arithmetic, these two figures are of the same order of magnitude. That is extraordinary in itself!

Even though what matters is where the SIR deletions happened and where BJP needs the votes to defeat TMC, still one thing is apparent.

For decades, TMC was operating with bloated rolls, duplicate entries, migrant/non-resident voters, and constituency-level inflation of rolls that favored incumbents.

SIR collapses the cushion that allowed TMC to win comfortably despite rising opposition vote share.

Mamata Banerjee's Bhabanipur constituency saw a significant impact of SIR.

The fact that Mamata Banerjee’s own constituency saw abnormally high deletions suggests that roll inflation was not peripheral; it was central and protected.Despite ideological contradictions, both converge on a single objective: preventing the BJP's normalization.

That is being dismantled. And, when the throne district bleeds, the structure's collapse is inevitable.

If Hindu vote crosses 55% consolidation, then BJP could be headed to a majority with 170+ seats.

If the BJP misplays Bengal again, the Northeast's vulnerability deepens. If it succeeds, national politics stabilizes around sovereignty and security, re-anchoring India’s political order for an entire generation.

Tamil Nadu: Shift, but will it be enough?

In Tamil Nadu, persistent anti-Sanatan rhetoric is proving to be a strategic miscalculation for the DMK.

While it may energize a loyal ideological base in the short term, over time it is eroding the party’s moral legitimacy among a broader section of society that sees such attacks as unnecessarily divisive rather than reformist.

The narrative increasingly appears less about social justice and more about cultural antagonism.

This shift indirectly benefits the BJP. Although the BJP remains organizationally weaker than the Dravidian majors and cannot yet translate sentiment into a full electoral breakthrough, it is steadily consolidating a cultural counter-narrative.

However, seat conversion may still lag sentiment.

Tamil Nadu’s entrenched alliance arithmetic and caste-vote transfer mechanics mean that ideological gains take at least one electoral cycle to mature into seats.

As a result, 2026 is more of a disruption election than a realignment election.

The likely outcome is a measurable but incomplete shift:

Kerala: Change is Coming

The Sabarimala Temple episode may have permanently altered Hindu political psychology in Kerala. What changed was not electoral preference overnight, but trust.

A large section of Hindu society has apparently concluded that the state, judiciary, and ruling elite were willing to override faith without hesitation.

That realization has hardened into memory, not grievance. It does not fade with time.

Yet electoral conversion remains structurally constrained. Demography still fragments Hindu voting across caste and region, while minority voting remains comparatively cohesive.

At the same time, the long-standing Church–Left compact continues to operate tactically. Despite ideological contradictions, both converge on a single objective: preventing the BJP's normalization. This alignment still holds for the 2026 cycle.

However, the recent local body elections have disrupted Kerala’s political equilibrium.

The most consequential development, however, was the BJP-led NDA’s historic capture of the Thiruvananthapuram City Corporation—a four-decade Left bastion.

This was not merely symbolic. It demonstrated that the BJP is no longer confined to the margins or protest votes. Urban Hindus, younger voters, and aspirational middle classes are beginning to treat it as a plausible political instrument, not an ideological outlier.

In 2026, the BJP is unlikely to break the bipolar LDF-UDF structure outright. But it is already functioning as a systemic disruptor and vote spoiler, particularly in marginal seats.

More importantly, Hindu consolidation is becoming irreversible. If and when Christians become disenchanted and worried because of Islamists and Leftists targeting aligns more strongly with Hindu fear, then things can turn around for the BJP.

Once identity, grievance, and political memory align, reversals do not occur quietly.

Prediction for India: Black Swan via Synchrocity?

Within a short window (say 6–10 weeks), India faces three simultaneous pressures that fuse into one domestic crisis:

- Bangladesh political breakdown (street violence, fractures in security services, refugee/migrant flows, border disorder)

- Pakistan-linked proxy escalation (high-salience terror or coordinated attacks timed to peak domestic emotion)

- China opportunism on the LAC (non-kinetic coercion + posture + logistics pressure that forces attention split)

Individually, India can manage each.

The Black Swan is when they synchronize and create a new situation:

A national security crisis that moves inside India faster than the state can compartmentalize it.

India’s adversaries do not need decisive battlefield victories to achieve strategic effect. Their objective is to fragment attention. And thereby forcing the Indian state to divide political focus, security bandwidth, and narrative control across multiple, simultaneous stress points.

The goal is overload, not conquest. At least not right away.

Instability in Bangladesh functions as a perimeter-weakening event. It creates physical porousness through expanded smuggling routes, irregular migration flows, and grey-zone logistical networks.

More critically, it generates narrative chaos—conflicting media frames, humanitarian pressure, and diplomatic noise that complicate India’s decision-making environment. Border instability, even without overt hostility, strains enforcement and intelligence capacity.

A proxy strike timed into such an environment becomes exponentially more damaging. The intent is not mass casualties alone, but domestic polarization—provoking communal tension, political blame cycles, and social distrust. This internal fragmentation imposes higher strategic costs than a conventional border skirmish, because it degrades cohesion, slows response loops, and turns security operations into political flashpoints.

Simultaneously, pressure along the LAC does not require escalation. China’s leverage lies in persistence, not provocation.

By maintaining unresolved friction, it ensures that Indian forces, logistics, and senior leadership attention remain “locked” in a holding pattern - unable to disengage or reprioritize without risk.

The pressure is constant, low-intensity, and deliberately distracting.

This is how civil war–like symptoms can surface without an actual civil war.

There could be overlapping shocks that fracture attention, exhaust institutions, and erode trust.

The danger lies not in collapse, but in cumulative distraction that weakens strategic coherence at precisely the wrong moment.

Prediction: A globally synchronized “payment rails outage” (not a bank run, but a network stop)

A cascading failure across major payment/settlement networks (SWIFT-adjacent messaging, card networks, core banking middleware, cloud IAM auth) could be triggered by either a software supply-chain issue, a worm, or a massive cloud control-plane outage.

It could be "COVID-scale." Why?

This will not necessarily see a “market crash.” It will cause a “money moves stop.”

Early signals: major cloud provider multi-region instability, widespread authentication outages, simultaneous bank “maintenance” windows, emergency central bank coordination calls.

A “Trust Collapse Event”

A major, convincing synthetic-media incident could trigger a set of real-world actions in a crisis that is truly COVID-like.

Why would it be important?

- It attacks the glue of society: shared reality.

- Governments react with emergency communications restrictions.

- Markets and crowds move on belief, not truth.

Second-order shock: accelerated censorship battles, internet fragmentation, and severe political violence in at least one major country.

Early signals: coordinated bot amplification, “verified-looking” forged emergency alerts, simultaneous rumor spikes across languages, high-profile account takeovers.

Prediction: “The Three-Theatre Trap”

A NATO–Russia flashpoint, Arctic escalation, and Indo-Pacific crisis will converge. And it will force strategic overload, decision paralysis, and deepening fractures across Western alliance systems.

A short sequence forces the U.S. into a perception of “coordinated pressure” even if it isn’t coordinated. Let us game play it -

- A NATO–Russia incident with casualties (Baltic/Black Sea air/sea collision, misfire, drone downing)

- Arctic gray-zone escalation (shipping harassment, undersea infrastructure incident, base-to-base signaling)

- Indo-Pacific crisis spike (Taiwan blockade rehearsal / high-intensity PLA exercise cycle)

None of these accidents alone would force a WW3. But collectively or more than one could spell potent danger.

So could there be a Black Swan event? Yes, but not the way you would think. It would be in what happens to U.S. decision-making.

Most strategic models assume the United States can sequence crises, say like Europe first or the Indo-Pacific first. As if priorities can be cleanly rotated.

In reality, the binding constraint is not force posture but alliance psychology.

NATO allies interpret U.S. restraint or delay as strategic abandonment, triggering hedging behavior and political fragmentation within the alliance.

In Asia, the same U.S. focus on Europe is read very differently. It presents an opening for China to test red lines, intimidate partners, or shift the facts on the ground. What is reassurance in one theater becomes vulnerability in another.

At home, U.S. domestic politics collapses both interpretations into a single narrative: endless commitments abroad with unclear benefits. That perception fuels skepticism toward alliances themselves, tightening political room for maneuver just as external pressure peaks.

That is the danger most models miss.

So how will we see it?

- NATO Article 4/5 language begins appearing in official comms while Indo-Pacific exercises intensify

- U.S. carrier/ISR allocation starts “robbing Peter to pay Paul” (visible gaps)

- Arctic incidents: undersea cable events, unexplained maritime clashes, heightened base alerts

- sudden allied diplomatic freelancing (“independent peace initiatives,” separate negotiations)

- domestic U.S. political rhetoric shifts from “deterrence” to “why are we everywhere?”

US will face synchronization risk and coalition confidence under time pressure.

The West’s power will not collapse in one instant, but it will undergo forced triage. The quiet normalization of “some risks must be tolerated.”

When that threshold is crossed, global order does not shatter overnight; it recalibrates permanently, with power diffusing outward, restraint eroding inward, and the age of uncontested Western synchronization coming to a close.

Comments ()