The End of American Command and the Rise of Chinese Control

China is replacing U.S. power not through war but through control of supply chains, industry, finance, and quantum tech. America still speaks like a hegemon, but China now controls the structure of power. The U.S. commands by narrative; China governs by capability.

The Two Builders

A young monk once asked his master,

“Master, who will win the struggle between the Eagle and the Dragon?”

The master smiled and pointed to two men building on opposite sides of a river.

The first man stood on a high rock, shouting instructions to the valley.

“Look at my great house!” he cried, though no stone had yet touched the ground.

The second man said nothing. He carved each stone in silence and laid it into the earth. Day after day, his house grew downward, not upward — disappearing into a deep foundation no one could see.

The young monk frowned.

“Master, the first man speaks of greatness. The second man builds only roots. How can he win?”

The master replied:

“The loud builder seeks applause before shelter.

The silent builder seeks shelter before applause.

When the storm comes, only the house with roots stands.”

The monk asked,

“And when the storm is over?”

The master said:

“The world will believe the house appeared overnight.”

Bottomline:

Dominance is not won by volume, but by foundations. The empire that speaks is already defending itself. The one that builds is already replacing it.

It is Diwali time now. Wishing everyone a very happy Diwali to everyone from the Drishtikone family. Remember, this is a spiritually important time that has manifested as a festival. This was the time when Shri Ram, along with his wife Sita came back to his home in Ayodhya. So, do not look at it as a "festival of lights". It becomes a time of festivities because of the spiritual significance of this time.

SUPPORT DRISHTIKONE

In an increasingly complex and shifting world, thoughtful analysis is rare and essential. At Drishtikone, we dedicate hundreds of dollars and hours each month to producing deep, independent insights on geopolitics, culture, and global trends. Our work is rigorous, fearless, and free from advertising and external influence, sustained solely by the support of readers like you. For over two decades, Drishtikone has remained a one-person labor of commitment: no staff, no corporate funding — just a deep belief in the importance of perspective, truth, and analysis. If our work helps you better understand the forces shaping our world, we invite you to support it with your contribution by subscribing to the paid version or a one-time gift. Your support directly fuels independent thinking. To contribute, choose the USD equivalent amount you are comfortable with in your own currency. You can head to the Contribute page and use Stripe or PayPal to make a contribution.

China is taking over the US?

Kash Patel, currently the FBI Director, has repeatedly raised alarms about Chinese land acquisitions near critical U.S. military bases and alleged Chinese penetration of key infrastructure, such as power grids and water systems.

Many others have also been discussing about these threats as well.

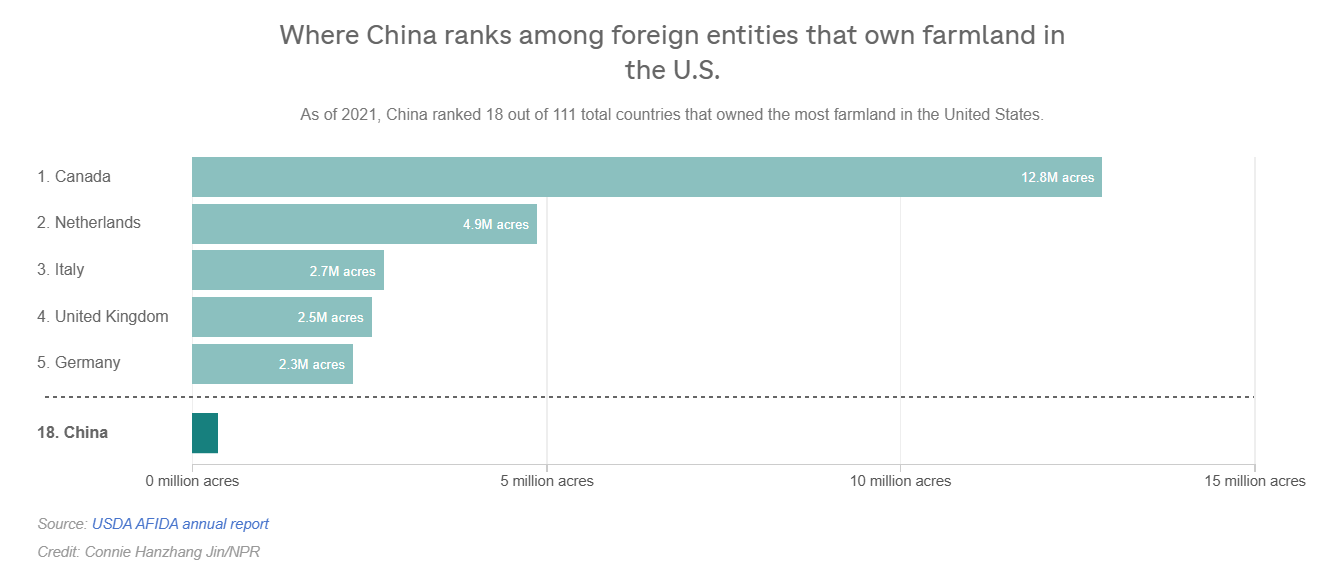

According to Adam Savit, director of the America First Policy Institute (AFPI) China Policy Initiative, the problem lies in China's National Intelligence Law of 2017, which obliges all Chinese organizations and citizens to cooperate with the country's intelligence services. "CCP-owned land plots near military installations are by definition a national security threat," Savit said. Chinese entities hold less than 350,000 acres of US agricultural land. That is just under 1% of all foreign-held acreage. While the footprint may seem small, Savit explained that "any parcel of land, however big or small, can be used as a platform for surveillance or sabotage by the Chinese Communist Party (CCP)." (Source: Chinese Land Buys Raise Security Alarms, AFPI Warns / Japan Forward)

Yes it seems alarming, but let us get some context.

So, the U.S. Department of Agriculture (USDA) recorded that Chinese-owned land totaled 383,935 acres. That is a significant increase from 13,720 acres in 2010. While ownership has been growing, the overall amount remains relatively low.

As large as these figures may seem for the foreign own land in the US, it is still less than 4% of the total agricultural land in US.

The amount of American cropland, pastureland and forestland owned by foreign investors continued to increase in 2023, according to a recent analysis by the American Farm Bureau Federation. Foreign citizens and companies owned 3.61% of American agriculture land, according the analysis from Farm Bureau economist Daniel Munch, which cites data from the U.S. Department of Agriculture. That percentage equals 45.9 million acres – an increase of 1.6 million acres from 2022. Canadian investors own or lease about one-third of this land, which is the most of any country. Renewable energy projects – especially wind energy – are driving much of this growth, continuing a multi-year trend. The analysis found that more than half of the increase of foreign-owned land from 2022 to 2023 was tied to entities with renewable energy-related names. The increase in foreign-owned farmland has been ongoing for several years. From 2010 to 2023, the total acreage grew by 21 million acres, according to the analysis. (Source: "Foreign ownership of U.S. farmland is still small but has increased, analysis shows" / IPM News)

Meanwhile, remember that Bill Gates alone owns

Bill Gates, co-founder of Microsoft, is not just a tech mogul and philanthropist. He's also the largest private owner of farmland in the United States, holding an impressive 275,000 acres across the country. (Source: Yahoo Finance)

Kash Patel's warnings, however, have triggered a vigorous national debate on the intersection of national security, foreign ownership, and infrastructure vulnerabilities.

The dynamics between the US and China is quite interesting these days.

There are China Doves and there are China Hawks. Those who see "Us and Them" and those who see "US vs Them".

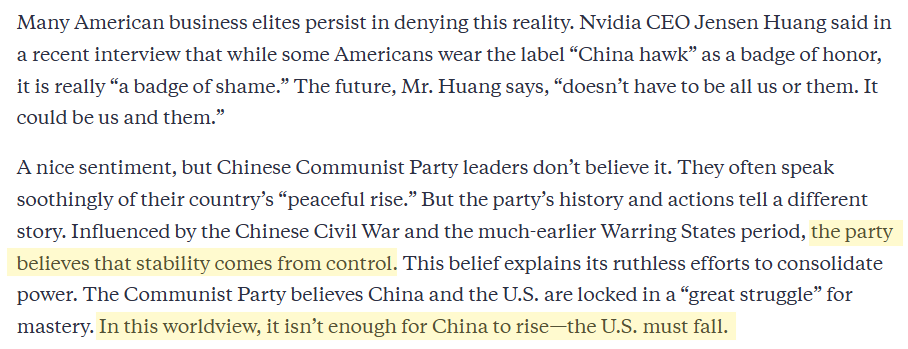

In response to Nvidia CEO Jensen Huang's "dove" style statements, Shyam Shankar, (CTO @Palantirtech, Chairman @Ginkgo) wrote in Wall Street Journal about how China does not just want its own rise, it also wants the fall of the US.

There is something amiss within the American circles these days that Shankar's words are symptomatic of.

The United States did not become a superpower simply by “being excellent”; it became hegemonic through a century of deliberate suppression of rivals — Germany (twice), Japan, the Soviet Union, Iran, Iraq, Libya, Afghanistan, and now Russia and China. British power before it was built on colonization, extraction, engineered famines, and systemic destruction of other civilizational centers of gravity — India being a classic example.

So the moral framing that “China is malicious because it wants the U.S. to fall” is less an ethical critique and more a case of hegemonic amnesia: the belief that what the U.S. does is “leadership,” but what China does is “aggression.”

All Hegemons Operate on Relative Power, Not Absolute Power

Great powers never measure strength by their own prosperity alone — but by the gap between themselves and everyone else. Strategic supremacy is always relative. America isn’t afraid of a wealthy China per se. It is afraid of a peer China. A system where China is technologically sovereign, industrially independent, and militarily untouchable is unacceptable to Washington because it would end the unipolar order.

Every hegemon therefore invests in active impediments to competitor growth: sanctions, coups, information warfare, technology bans, proxy conflicts, currency wars, and “regime change” diplomacy. American analysts portraying China as uniquely malignant for engaging in power politics is an inversion of reality — China is simply doing what the U.S. has done for a century.

The Moral Narrative is a Cover for Power Projection

What is unusual is not China’s worldview — it is that American commentators still clothe their own geopolitical actions in the language of morality, democracy, or “preserving the rules-based order.” The “rules” simply mean: rules written by the hegemon, for the hegemon. When the U.S. topples governments, funds militant proxies, weaponizes financial infrastructure, or engineers color revolutions, it is sold to the world as “freedom.” When China uses trade, infrastructure, industry, and diplomacy, it is framed as “authoritarian expansion.”

The Real Competition is Civilizational Competence

China frames its contest with the U.S. as historical correction. The U.S. frames it as cosmic morality. But behind both narratives lies the same core truth: global power is never about goodness — it is about centrality, leverage, and denial of alternatives.

The morality play is a smokescreen. The structure is realpolitik. And it always has been.

If you were to look at the commentary that comes out from different stages of where a global power is, you will see a pattern. I have seen many Indian commentators of the past, during colonization fashion the competitive stances of Britain and Indians in almost naive moralistic manner.

So, Shankar's stance is nothing new really.

This is a civilizational pattern.

When the leverage weakens, commentary becomes flooded with:

- Mythologizing the past (“We built the world order,” “We saved the world in WWII,” “We kept the seas open”)

- Delegitimizing the rival (“China is immoral,” “Russia is barbaric,” “India is authoritarian,” etc.)

- Self-canonization (“We stand for freedom,” “We are the guardians of democracy”)

This is exactly what late-stage British elites sounded like after WWI and especially after WWII — talking about “civilizing mission” even when they could not hold Burma or Egypt. The French did the same after losing Indochina and Algeria.

The Ottomans, at the end, spoke endlessly about past grandeur and Islamic stewardship while losing every province.

You see, when muscle fades, narrative becomes the last weapon.

Today, the U.S. cannot sanction China into submission, cannot militarily coerce it, cannot out-manufacture it, and cannot decouple without self-harm. So commentators deploy the only remaining low-cost instrument: moral exceptionalism.

If the U.S. were still fully hegemonic, it would not be talking about preserving the rules-based order — it would be enforcing it.

This is the hallmark of strategic insecurity:

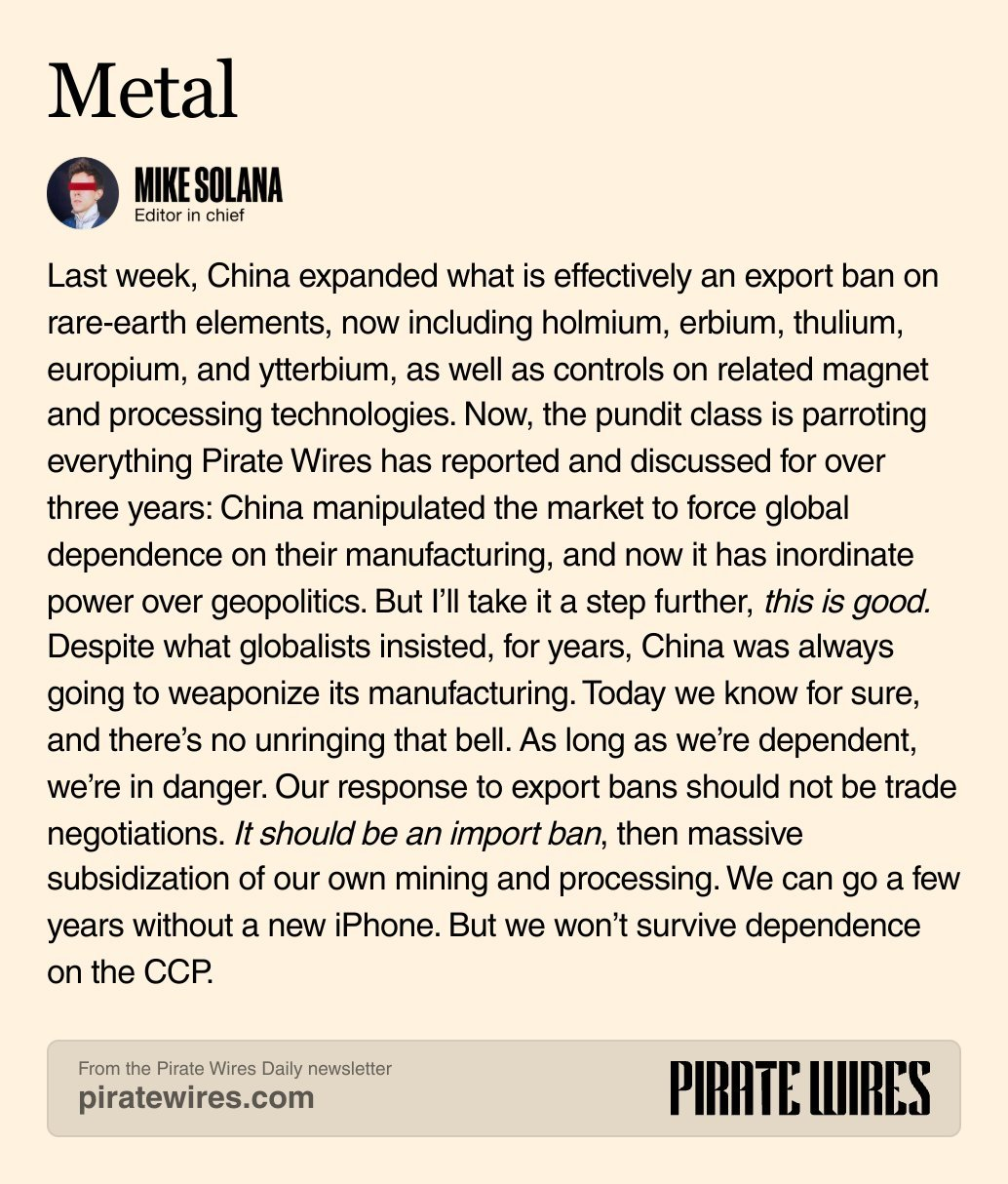

Interestingly, in one of his X posts, Shankar shares this suggestion from Mike Solana (billionaire media tycoon and former mayor of san francisco. Disinformation researcher. cmo @foundersfund. editor-in-chief @piratewires)

One finds it surprising, rather disconcerting, when an analyst of Solana's stature acts as a Rip Van Winkle when he states "Today we know for sure..."

Solana framing it as this as “now we know China is weaponizing manufacturing” may seem interesting, but this “now” is about 20 years too late!

During these years, broadly this is what has happened, specifically with respect to the rare earth elements trade.

- 90%+ of rare-earth processing is already controlled by China

- The supply chains are not just extraction-based, but processing based (the real bottleneck)

- It took China 30 years of subsidized industrial statecraft to pull this off

- The West offshored capacity voluntarily to boost shareholder value

The rare earths ban by China is obvious rankling Americans, as it hits at the base of every future innovation and weapon system.

In 2023, Raytheon CEO Greg Hayes statement was shared by Matt Stoller (Researcher at http://economicliberties.us) who was shocked at the situation.

The unfortunate reality is that substantial percentage of American military is today "Made in China"!

The Pentagon’s $400 million supply chain review and Congressional analyses have revealed significant, strategic vulnerabilities stemming from heavy reliance on Chinese suppliers for critical military hardware and logistical infrastructure.

The Pentagon’s arsenal and defense industrial base is built on materials that China can turn off like a light switch. Growing uncertainty in critical mineral markets and the open weaponization of supply chains by China has prompted a paradigm shift in how the Pentagon addresses these issues. In July 2025, the Department of Defense and MP Materials structured a package comprising equity in the company, a 10-year price floor for certain rare earth elements, long-term magnet offtake, and project financing. This represents a major departure from previous investments to support the defense industrial base. It also appears successful in attracting sizable private capital. But exposure remains acute because China dominates many device-grade processes and has layered export license controls on almost a dozen critical materials since August 2023. Although a new trade framework resumed shipments for rare-earth magnets, licensing discretion remains in China’s hands. (Source: "These Materials Could Cripple America’s Defense Industrial Base" / War on the Rocks)

Going back to Solana, we need to understand that banning Chinese minerals does not create Western minerals.

What is the Solution?

An import ban without pre-existing domestic capability = supply shock, not independence. It is as smart as saying “We have no oxygen cylinder. So let’s just hold our breath until we grow lungs.”

The real solution to U.S. dependence on China is not an import ban, but a full-scale rebuilding of the industrial base — including mining, refining, and advanced materials manufacturing.

Make no mistakes, this would require decades, not months!

But the political and economic system in the U.S. is structurally incapable of doing this.

American capital markets are built on short-term returns, not 20-year industrial ROI cycles.

Regulatory layers — ESG mandates, environmental lawsuits, and NIMBY-style activism — make new extraction or refining facilities nearly impossible to build.

Voters want technological sovereignty, but not the pollution and land use consequences that come with it. And Wall Street spent three decades deliberately offshoring these “dirty” foundational industries to protect margins and share prices.

So the real obstacle isn’t technological capacity — it is political economy.

Strategic sovereignty requires sacrifice, patience, and national industrial discipline.

The United States has made itself in a certain way when it comes to its economic model and how it rewards. The fact is that it no longer lends itself to a society that can handle or even tolerate reindustrialization. And at the pace that China's decoupling requires US to do it, is well nigh impossible.

China Versus the United States - a Quick Review

We have already seen how dependent the US military is on China.

We will now check the extreme vulnerabilities that US has with respect to China.

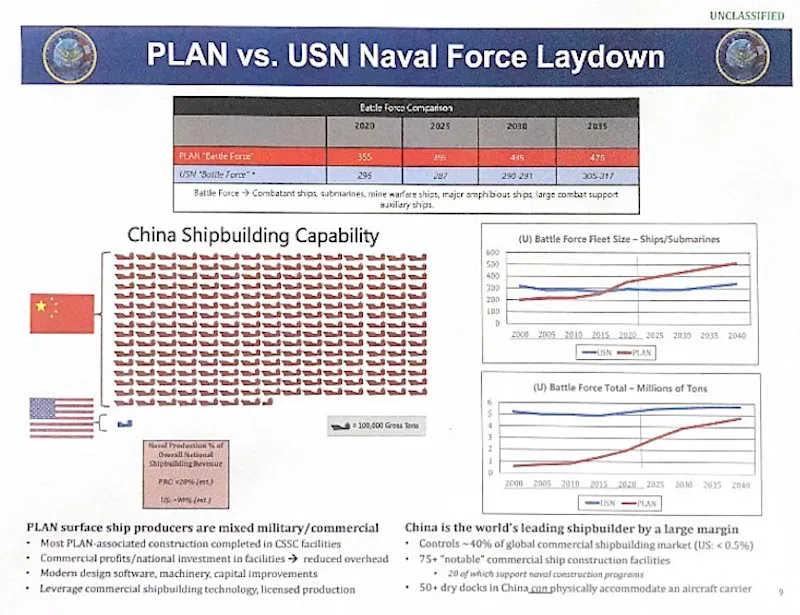

A leaked U.S. Navy intelligence slide has confirmed that China's shipbuilding capacity is over 200 times greater than that of the United States, with Chinese shipyards boasting around 23.2 million tons of capacity compared to less than 100,000 tons in the U.S.. This disparity has alarmed American defense officials and highlights growing concerns about the strategic gap in naval production capabilities.

China's shipbuilding capacity is 232 times greater than the US, per leaked US Navy intelligence. A leaked US Navy briefing slide with the information circulated online in July, per The War Zone, an online newsletter. The slide was titled "PLAN vs. USN Naval Force Laydown," and appeared to be marked "unclassified." According to the data seen in the slide, China's shipyards have a capacity of over 23.2 million tons, more than 232 times greater than the US capacity of less than 100,000 tons. The slide also appears to contrast the "battle force composition" of both navies, taking into account "combatant ships, submarines, mine warfare ships, major amphibious ships, and large combat support auxiliary ships." A US Navy spokesperson told Fox News Digital in an article published on September 14 that the briefing slide is authentic. (Source: China has the capacity to build PLA combat ships at 200 times the rate that the US can, per leaked US Navy intelligence / Business Insider)

The Office of Naval Intelligence (ONI) created the slide to illustrate the massive difference in shipbuilding capacity, and its authenticity was confirmed by the Navy. The slide shows that Chinese shipyards have a capacity exceeding 23,250,000 tons, which is at least 232 times greater than the United States, whose capacity is below 100,000 tons.

This figure is not just a rough estimate—multiple reputable sources cite that China's shipbuilding output and infrastructure far exceed any U.S. capability, both in warship and commercial vessel construction.

The gap in shipbuilding capacity directly affects fleet modernization and overall naval force readiness. Chinese shipyards can produce warships, submarines, and support vessels at rates that would allow for rapid expansion or replacement in wartime scenarios, while the U.S. faces constraints in its ability to do so.

China’s largest state-owned shipyard, the China State Shipbuilding Corporation (CSSC), built more commercial vessels by tonnage in 2024 than the entire US shipbuilding industry had since World War II. This reflects the declining shipbuilding capability of the US, which currently has only four active public shipyards compared to China’s 35 sites. China has implemented shipbuilding policies that have proved detrimental to the US and its allies’ shipbuilding industry. Japan and South Korea, which once dominated the market, are now struggling to keep pace with China. The share of the US commercial shipbuilding sector has plummeted to just 0.11 percent of the global total in 2024. The Chinese Navy is undoubtedly the biggest naval force in the world, with a flotilla of over 370 ships and submarines. The US has the advantage in terms of guided-missile cruisers and destroyers. Also, its 11 aircraft carriers ensured that it has more tonnage than China. However, the latest report by the Center for Strategic and International Studies (CSIS) has revised the estimated vessel numbers for the PLA-Navy in its latest report earlier this week. In its report “Ship Wars – Confronting China’s Dual-Use Shipbuilding Empires,” the CSIS says that China would have a 425-ship strong fleet by 2030, compared to the US Navy’s 300 vessels. The 2024 report from CSIS indicated that the PLA Navy operated 234 warships against the US Navy’s 219. (Source: "“Ship Wars”: China Builds More Vessels By Tonnage Than U.S. Has Produced Since WW-II; Can U.S. Make A Comeback?" / Eurasian Times)

Analysts warn that unless the U.S. addresses these industrial shortfalls, American naval superiority could be jeopardized in a future conflict, especially in the Indo-Pacific region.

The numbers reveal a long-term structural collapse in U.S. shipbuilding capacity — one that began even before the Cold War ended and has only accelerated since.

Washington’s response today — calls to “invest” or “revitalize” — is less a solution and more an admission of the irreversible gap. This is not a momentary imbalance, you see. It is an asymmetrical industrial reality.

China is no longer merely ahead in output.

China has now seized command of the production base itself.

That creates a downstream military consequence: the U.S. can deploy, but China can replace and expand faster than American yards can even initiate a build cycle.

This is why the shipbuilding gap should not be seen just an economic statistic. It is a strategic vulnerability. In any serious crisis or protracted naval confrontation, the side that can replenish hulls, engines, steel, and logistics wins.

Today, that advantage belongs decisively to China.

The Hypersonic Threat

Secretary of Defense Pete Hegseth has stated on the Shawn Ryan podcast.

Secretary of Defense Pete Hegseth went on the Shawn Ryan podcast. Here is the video above. In this video (1:22:22 to 1:23:24), he shares something devastating.

Hegseth then goes on to discuss that China has built a military force specifically designed to defeat the U.S., highlighting the rapid advances in China's hypersonic missile technology and the growing vulnerability of American carrier strike groups to these weapons.

He noted that in all recent Pentagon war games simulating a US-China conflict over Taiwan, the US side has lost, underscoring concerns among senior defense officials about the asymmetric threat posed by China’s rapidly improving missile arsenal.

Hegseth also discussed the slow pace of U.S. weapons procurement and bureaucratic constraints, which he argues have allowed China to leap ahead in hypersonic missile and naval production.

The Quantum Lead

Here is a claim that may shock you.

The United States is a decade behind China in quantum computing.

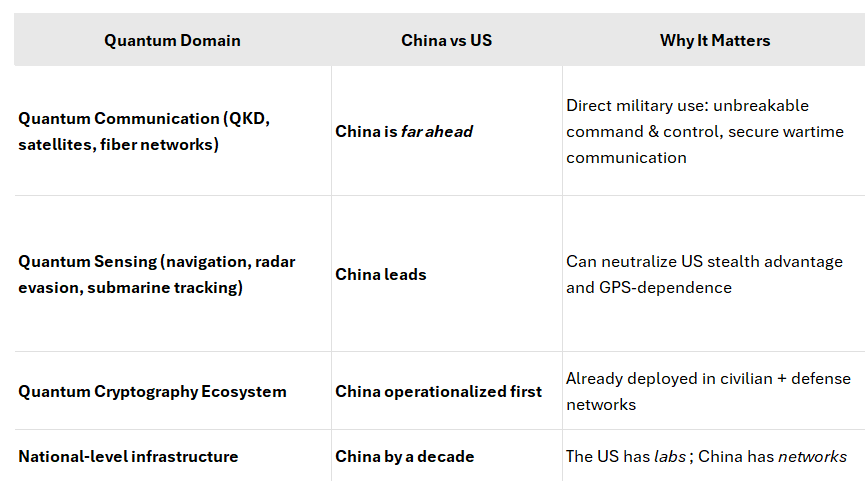

“China is about a decade ahead of us on quantum, and that's specifically because they never fought a war on terror,” said Theresa Melvin, chief technology officer for high-performance computing and artificial intelligence (AI) at Aerospike, a technology company. Quantum computing leverages quantum mechanics to perform complex calculations exponentially faster than classical computers, making it crucial for military applications like cryptography, AI and simulations of advanced defense systems and strategies. A Chinese daily recently published that scientists had harnessed computing power to break military-grade encryption. While this claim has been later debunked, it is widely recognized that Beijing has an advantage over the United States in this field. “The fact that if they can actually break the encryption, whether or not we have post-quantum encryption, all the material we have classified will be available to them as soon as they break it,” said Tung Ho, director of the Center for Intelligence, Research and Analysis at Exovera, an information services business. (Source: "U.S. Trails China by a Decade in Quantum Computing" / AFCEA)

To assess the claim that China is "10 years ahead" of the US in quantum computing, we need a comprehensive analysis.

This assessment should extend beyond mere theoretical research to include the engineering-to-deployment cycle, which is crucial for real-world applications.

The US approach to quantum computing is predominantly corporate-led, characterized by private sector innovation and investment. In contrast, China's strategy is state-led and militarized, with significant government funding and strategic planning.

This state-sponsored approach allows China to potentially accelerate the development and deployment of quantum technologies, aligning research with national security and economic goals. While both countries are investing heavily in quantum computing, the centralized control and prioritization in China might give it an edge in certain areas.

Areas where the US is decidedly strong and ahead of China are:

- Quantum computing hardware R&D

- Algorithms / theory

- Venture innovation

Quantum supremacy is not merely a scientific milestone.

In fact, it rewrites the foundations of military power.

The future of conflict is shifting from dominance through firepower to dominance through information denial.

With quantum-secure communication, China can operate command-and-control networks that U.S. intelligence cannot penetrate or disrupt, granting Beijing a first-ever shielded battlespace.

At the same time, quantum sensing threatens to expose what was once undetectable. If Chinese sensors can reliably track stealth submarines — the core of America’s “second-strike” nuclear deterrent — then the entire logic of strategic stability is upended.

Deterrence collapses when invisibility collapses.

Quantum navigation further erodes U.S. advantage by eliminating dependence on satellites. A military force that can maneuver without GPS becomes far more resilient than one whose entire system breaks down when space infrastructure is jammed or disabled.

And perhaps the most far-reaching effect: cyberwar flips direction.

Quantum decryption will eventually make existing encryption obsolete, allowing China to unlock troves of stolen U.S. and allied data accumulated over decades.

In short: quantum technology shifts the balance of power from industrial superiority to information sovereignty — a domain where China is pulling ahead.

China’s advantage in quantum is not academic — it is operational.

In the domains that matter for warfighting, espionage, encryption, and sovereign communications, China is an estimated 8–12 years ahead of the United States.

The West still treats quantum as a research frontier; China treats it as a force multiplier to redesign the battlefield.

American labs can still match China on theory and prototypes — IBM, Google, MIT, and others are pushing boundaries. But none of that translates into strategic leverage because the U.S. innovation system is corporate-led, not state-integrated. Silicon Valley builds demonstrators.

Beijing, on the other hand, builds deployment chains.

That is the real gap.

The U.S. is inventing quantum. China is weaponizing it.

Washington still believes dominance flows from patents and talent. Beijing understands dominance flows from militarized infrastructure — from fiber networks to satellite QKD to quantum-hardened command links.

China may not necessarily be winning the race in the lab. But it is surely winning it on the battlefield even before the battle begins.

With that background, one should not look at the Quantum supremacy as a technology race.

It is a sovereignty race.

When China fully stabilizes quantum-secure communications and navigation, the entire U.S. coercive toolkit will begin to break down.

The geopolitical equation flips, you see.

America spent a decade trying to dominate through chips and AI — upgrades inside the existing digital paradigm. China is leaping outside the paradigm altogether, building physics-level control that can erase U.S. advantage at the root.

Washington is reaching for a sword. Beijing is building the shield that makes the sword irrelevant.

This is why quantum is not just the “next technology.” It is the foundation upon which control over every future technology will rest.

The Financial Arena

The U.S.–China power dynamic is unfolding not only in factories and shipyards but also in the global financial arena.

The Deweaponization of the US Dollar and in some ways dedollarization inches to be a reality every day.

Recent macroeconomic trends clearly point to a significant realignment: the U.S. dollar-centric order is showing cracks, while alternatives like gold (and even digital assets) are gaining favor amid geopolitical uncertainty. These developments carry important implications for American economic leadership and the dollar’s status as the world’s primary reserve currency.

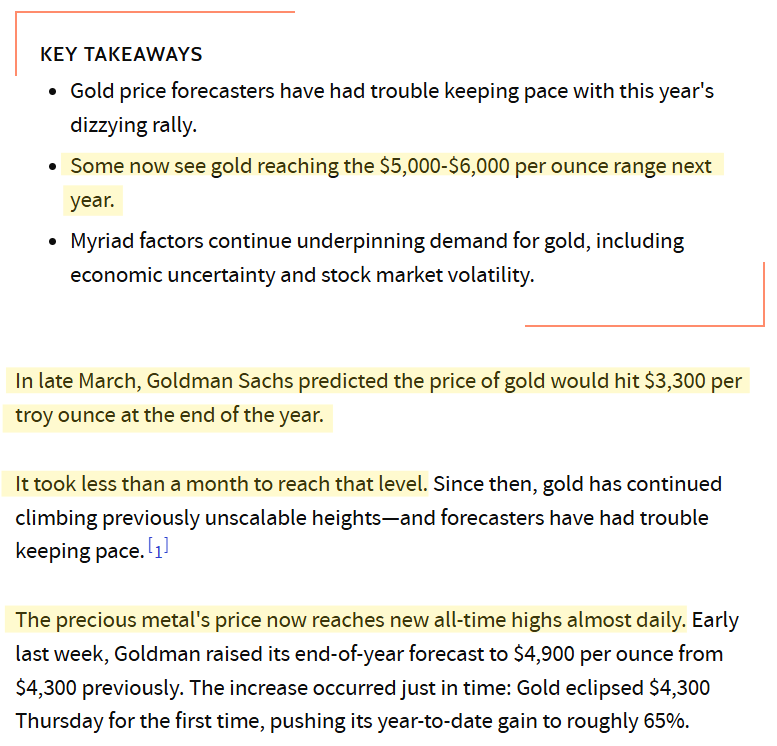

One key indicator is the surging price of gold. In 2025, gold has repeatedly smashed record highs, trading well above $4,000 per ounce and even spiking past $4,300/oz in mid-October. This marks dozens of new all-time highs for gold just this year. The rally in gold – often dubbed a “safe-haven” asset – reflects investors’ flight to stability amid weakening confidence in the dollar and concerns about U.S. fiscal health.

Geopolitical uncertainty and fears of American financial instability have led global central banks and investors to diversify their portfolios, boosting gold and other stores of value.

Indeed, analysts note that weakening confidence in the dollar is a primary driver behind gold’s record-breaking run. As one financial commentary put it, “gold and digital gold are smashing all-time highs, because the dollar is crashing through all-time lows.”

The U.S. dollar’s role as the linchpin of global finance is being tested. In part due to U.S. trade retrenchment and aggressive monetary expansion in recent years.

As Economist Gabriele Ciminelli, with ADB’s Economic Research and Development Impact Department, shared recently the dollar has slid about 7% from its 2025 peak and shows signs of continued decline.

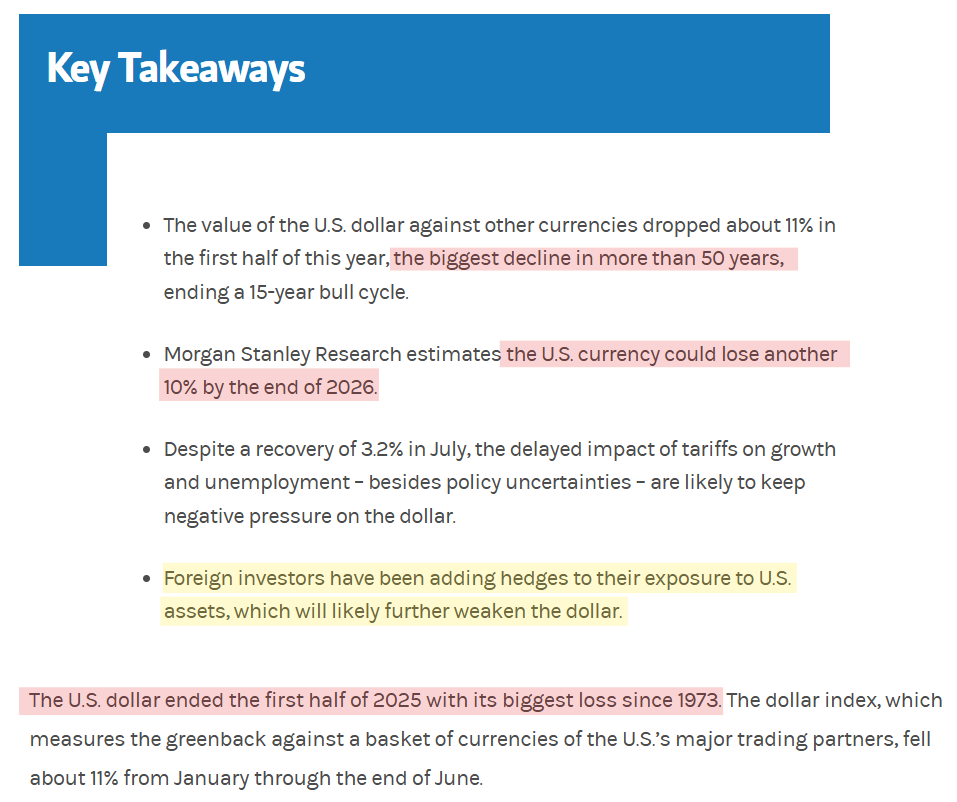

Morgan Stanley research says that USD has dropped 11% in the first half of this year and it is likely to decline by another 10% by end of 2026. The way the trends are going, that may be a gross underestimation!

More fundamentally, the share of global foreign exchange reserves held in dollars has been gradually falling (reaching its lowest proportion in decades, as multiple reports note), as countries seek to hold more gold and other currencies to hedge against dollar weakness. U.S. policies – such as expansive sanctions and tariffs, or large-scale deficit financing – have inadvertently encouraged some nations to seek alternatives to dollar dependence (for instance, China and Russia trading in yuan, or the BRICS discussing a new currency framework).

The proportion of dollars in the coffers of foreign central banks hit its lowest mark since 1995, a shift driven by a steep decline in the currency rather than a reduction in holdings. The balance of greenbacks in international reserves dropped to 56.3% between April and June, the International Monetary Fund said Wednesday. That’s a fall of nearly 1.5 percentage points from the first quarter and the lowest level in three decades. In constant currency terms, however, the dollar’s share was largely unchanged. (Source: Dollar Slump Puts Share of Foreign Reserves at 30-Year Low / Bloomberg)

The result is what IMF has described as the “Stealth erosion of dollar dominance".

While the dollar is far from being displaced as the top reserve currency, these trends hint at a multi-polar monetary future where the dollar’s preeminence is not taken for granted.

The Shrinking US Debt "tax base"

There is an important perspective that we need to remember. A critical factor here is the “global tax base” for U.S. inflation.

Historically, the dollar’s reserve status allowed the U.S. to run large deficits and print currency with much of the inflationary impact absorbed by foreign holders of dollars.

Essentially, the U.S. could export inflation (which many call United States' largest export!) – a phenomenon sometimes likened to a form of “global taxation” for others using the dollar.

However, as the U.S. pulls back militarily and economically from some overseas engagements and if more trade shifts out of dollars, this mechanism weakens.

So, if fewer foreigners use/hold dollars, any new dollar printing will be absorbed by the domestic economy, creating higher inflation at home.

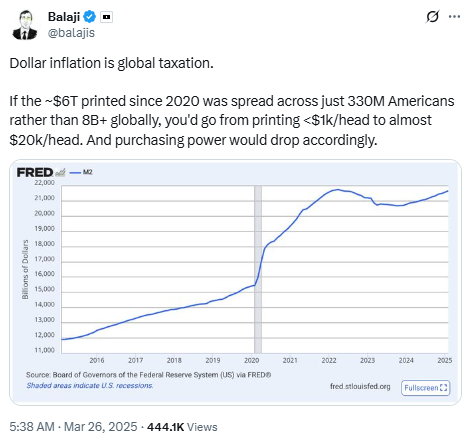

An interesting analysis by Balaji illustrates how as U.S. global influence contracts, the “de facto tax base for dollar inflation” shrinks from 1–3 billion people globally to just 330 million Americans – a decline of 70–90% in the base over which inflation is spread.

Such a contraction would mean a “huge drop in American living standards,” as domestic prices rise faster to pick up the slack.

The consequences for U.S. economic autonomy and power are significant. If the dollar’s international role diminishes, the U.S. government faces higher borrowing costs and less fiscal room to maneuver.

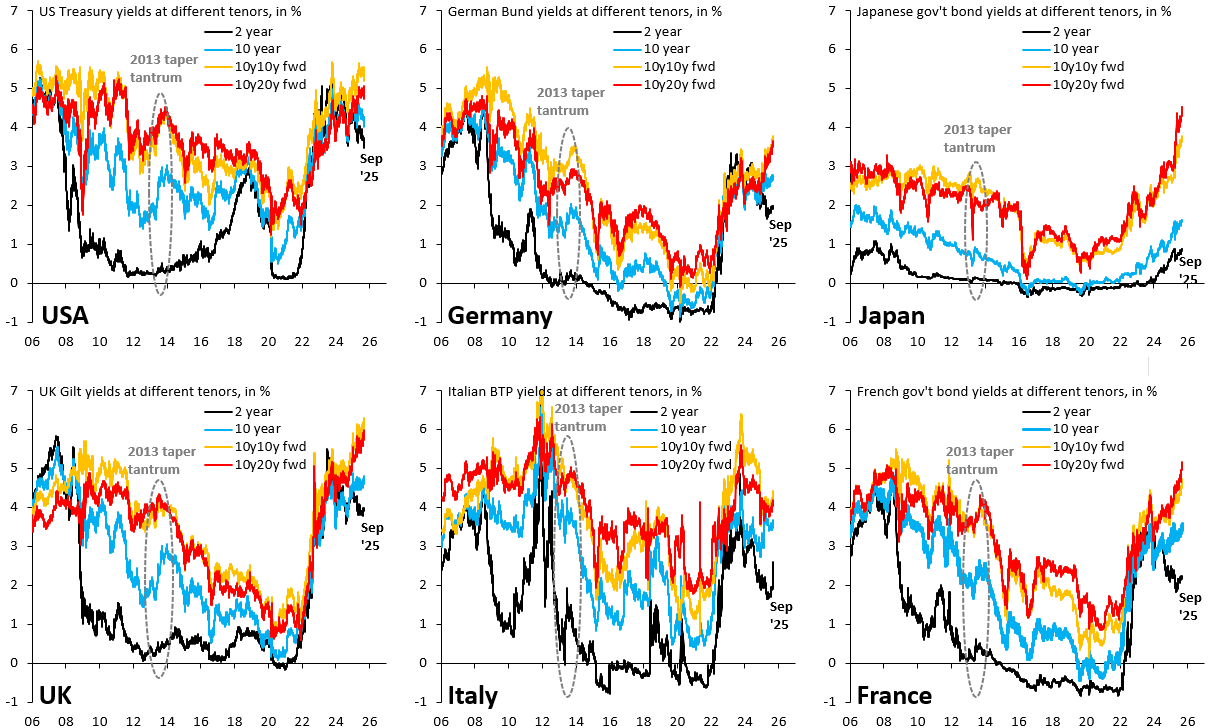

Already, rising U.S. Treasury yields (above 5% in 2025 for the 10-year bond) signal that investors demand more return to hold U.S. debt, reflecting concerns about inflation and debt sustainability.

Western economies broadly (U.S., Europe, Japan) are grappling with a sovereign debt crisis of high yields and large debts, even as China’s government bond yields have fallen (seen as a relative safe haven).

Robin Brooks (Senior Fellow @BrookingsInst, previously Chief Economist @IIF and Chief FX Strategist @GoldmanSachs) shares an interesting set of charts on the government bond yields in six countries.

This divergence – Western yields spiking while China’s remain low – highlights shifting perceptions that Asia, led by China, is becoming the world’s stable economic core as the West struggles with debt and inflation.

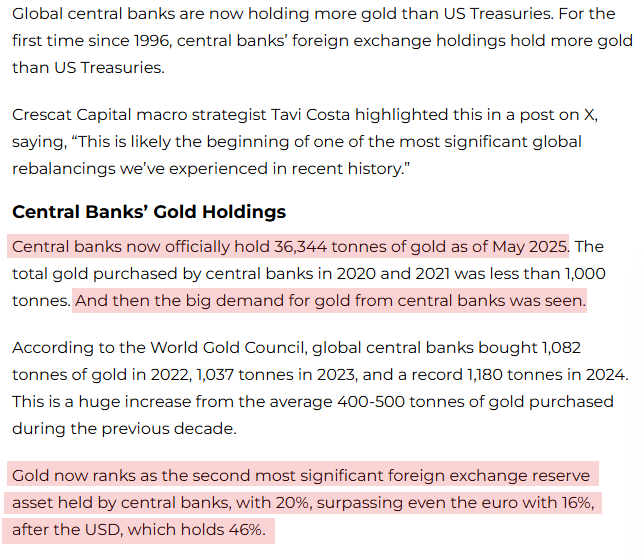

A tangible example: in the first half of the 2020s, central banks worldwide have been accumulating gold at the fastest pace in decades, much of it presumably to diversify reserves away from the dollar.

China itself has reported significant increases in its gold reserves over multiple consecutive months, and countries like Russia, India, and Turkey have also added to gold holdings.

The price of gold surpassing $4,000 is both a barometer of investor anxiety about fiat currencies and a catalyst for further reserve diversification. Some mainstream analysts now openly discuss scenarios in which the U.S. could “lose its dollar dominance,” and caution that Washington “cannot afford” complacency on this front. If the dollar were to lose substantial reserve currency status, the U.S. would lose the exorbitant privilege of easy financing and face more immediate constraints – a shift that would have far-reaching strategic implications (from funding the defense budget to projecting economic influence abroad).

In response to these trends, U.S. policymakers need to reinforce confidence in the dollar (through sound fiscal and monetary policy) and work with allies to maintain the currency architecture that underpins American influence. Efforts like currency swap lines, digital dollar innovations, or simply reducing deficit reliance on foreign creditors are part of the equation. The stakes are not purely economic; they translate into geopolitical leverage.

A weaker dollar diminishes America’s ability to sanction adversaries and to shape global financial norms. It also potentially empowers China, which has been promoting the international use of the renminbi in trade and investing in institutions like the Asian Infrastructure Investment Bank (AIIB) that provide alternatives to dollar-based systems.

In summary, the global macroeconomic landscape is shifting under the weight of great-power competition and internal financial strains. The U.S. finds itself in a period of monetary uncertainty, where maintaining the dollar-led order requires careful navigation of inflation, debt, and international trust.

The rise in gold prices and the subtle drift from the dollar are flashing warning signs. For decision-makers, this means policies that shore up the credibility of U.S. finances (thus preserving dollar primacy) are a matter of national security. It also means preparing for a world in which financial power is more diffuse, requiring greater cooperation with allies to uphold a rules-based economic system.

China - Global Power Without an Ideological Export

Parallel to material measures of power, the struggle for global influence has an ideational component – the realm of “soft power” and the export of cultural or political values. Historically, great powers underwrote not just trade routes and security alliances, but also ideologies and universal principles that other societies found attractive (or at least widely applicable). In today’s world, some observers see an emerging vacuum of ideas: Western democratic liberalism has lost some of its luster in recent years, while China’s rise has not been accompanied by a compelling new global ideology to rival the appeal of democracy or human rights. This dynamic raises questions about who, if anyone, will win the hearts and minds of populations worldwide in the 21st century – and what it means for global leadership when raw economic power is unmatched by equivalent soft power.

Western soft power is widely viewed as having declined in the past decade. The United States, in particular, saw its international image take hits after the Iraq War, during the polarizing Trump era, and through internal crises like political polarization and social unrest. Confidence in the U.S. model of governance has ebbed in many regions; for instance, Pew Research Center polls recorded sharply lower favorable opinions of the U.S. in various countries around 2020. European soft power – rooted in the EU’s advocacy of rule of law, multilateralism, and cultural diplomacy – has also been tested by internal challenges (Eurozone crises, Brexit, migration disputes). While the West still projects enormous cultural influence (through entertainment, academia, technology, etc.), its moral authority and unity of message have eroded, according to numerous analysts (Source: nafsa.org). In short, the narrative of liberal democracy as the inevitable path to prosperity has been contested of late, both by external propaganda and by internal dysfunction.

Yet China, despite its economic clout, has not managed to fill this void with a widely attractive narrative of its own. Beijing has certainly tried: it spends billions of dollars on soft power efforts – from global media outlets (CGTN, Xinhua) and Confucius Institutes teaching Chinese language, to big-ticket cultural events and development initiatives like the Belt and Road (which is as much about political messaging as infrastructure) (Source: cfr.org). However, return on this investment has been limited.

Surveys indicate that China’s image has not substantially improved in many parts of the world; in fact, unfavorable views of China have increased in North America, Europe, and parts of Asia in recent years (Source: rusi.org).

The reasons are manifold: China’s authoritarian political system, its crackdowns on dissent (Xinjiang camps, Hong Kong), and aggressive “Wolf Warrior” diplomacy often alienate global audiences rather than inspire them.

Unlike the U.S. or Europe, which for all their faults at least profess universal ideals (freedom, democracy, human rights), China under the Communist Party does not champion a universal ideology that others can easily sign onto.

Its official slogans – a “Community of Common Destiny”, “Socialism with Chinese Characteristics”, etc. – remain vague or unpersuasive beyond its borders. Chinese culture and ideas historically have spread, but in modern times they have not been codified into a global “value system” for export.

A useful way to frame this is the observation that China is a great exporter of goods, but an importer of ideas.

Throughout its history, China adopted and adapted external ideologies: it took in Buddhism from India centuries ago, Marxism-Leninism from Europe in the 20th century, and elements of market capitalism (“technocapitalism”) from the West in its reform era.

In each case, China “forked” these imports into something uniquely Chinese – e.g., Communism with Chinese characteristics, or a hybrid state-driven capitalism – but it did not originate these conceptual frameworks itself.

In the realm of global ideas, China’s influence has been more visual and material than ideational: it presents the world images of modernity (shiny skyscrapers, high-speed rail, blockbuster movies, viral TikTok videos) – a sort of “visual vibe” export – yet it hasn’t articulated a verbal or philosophical vision that captures the global imagination.

If you honestly look at it, Chinese culture today exports “TikTok and Hong Kong cinema” more than any sweeping political philosophy.

Yes, there is admiration for China’s development success and technological prowess, especially in the Global South, but that has not translated into a widespread desire to emulate China’s governance model. Even countries that partner with Beijing economically often remain wary of its political system and intentions.

This creates a sort of civilizational vacuum or at least a contest of narratives.

Western liberal values, though tarnished, still have strong appeal in many quarters – for example, pro-democracy movements and the enduring allure of Western education and media attest to that.

China’s rise, meanwhile, has not been accompanied by a compelling new ideology. Unlike past superpowers – consider that Britain spread parliamentary governance and free trade norms; the U.S. spread liberal democracy and human rights frameworks – China does not yet offer a universally resonant idea or ideology for others to rally around.

Beijing’s message often emphasizes respect for sovereignty and economic development (appealing to governments, perhaps), but it lacks an ideological magnetism for the people in foreign nations. Even China’s much-touted concept of a “multipolar world” or an “Asian century” is more a reflection of shifting power than an exportable value system.

Why does this matter?

The Western alliance after WWII was cemented not only by fear of the Soviet Union but by shared democratic ideals and cultural affinity – a profound advantage in the Cold War. Similarly, U.S. soft power (Hollywood, blue jeans, the English language, the internet culture) has often given Washington a persuasive edge that outlasts transient policy disputes.

If that soft power ebbs and China cannot effectively replace it, the world could see more nations following only narrow self-interest or aligning based on transactional gains (loans, trade) without genuine loyalty. A scenario could emerge in which global leadership becomes “transactional or material, rather than deeply transformative or inspirational,” as one analysis warned of China’s influence.

In other words, countries might take China’s investment and vaccines, but not admire China or willingly adopt its political values. This limits the depth of allegiance others will have to China’s cause in a crisis – an important consideration for Beijing’s long-term strategy.

Furthermore, history suggests that lasting global leadership has typically required a strong ideational component.

The great powers that sustained influence (whether it was the spread of Roman law, British notions of liberty, or American concepts of democracy and free enterprise) backed their might with ideas that transcended borders.

China’s impressive 5,000-year civilization has rich philosophical traditions (Confucianism, etc.), yet the modern Chinese state has not internationalized these in a way that shapes other nations’ governance. Confucius Institutes teach language and culture but do not convert societies to Confucian thought.

Meanwhile, Western soft power, though down, is not out – Western universities, media, and brands remain globally dominant and often set standards in education, science, and lifestyle. So we are in a complex interregnum: Western “universalism” is under question, Chinese “civilizational” appeal is limited, and other models (e.g. political Islam, regional nationalism) fill some gaps but not on a universal scale.

This could indeed be described as an ideological vacuum.

Neither Washington nor Beijing presently offers a compelling, unifying vision for the world’s future that is broadly embraced outside their own spheres. The risk is that in this vacuum, cooperation on global challenges suffers – without shared values or at least a shared narrative, building international consensus (on issues like climate change, human rights, or global governance reforms) becomes harder.

It might also mean that influence is exercised more through coercion or inducement (hard power, money) than persuasion, which can lead to more brittle relationships.

For U.S. policymakers, the decline of Western soft power is a call to renew the sources of that soft power – by addressing domestic flaws (showing democracy can still deliver), by investing in cultural and diplomatic outreach, and by highlighting the contrast between an open society and China’s authoritarian approach.

America’s story needs retelling in a way that resonates with younger generations globally, many of whom are skeptical of all great powers. For China’s part, if it seeks true global leadership, it faces the challenge of articulating an inclusive ideological narrative or set of values that goes beyond “China first.”

So far, its attempts (such as framing itself as champion of the developing world or the principle of non-interference) have had limited reach; they may earn goodwill in certain contexts (e.g., Africa appreciates Chinese infrastructure investment without lectures on governance), but they do not ignite inspiration.

In summary, material power alone may not guarantee hegemonic status if it isn’t coupled with ideological appeal. China’s dominance, if confined to economics and military might, could lack the “voluntary allegiance” from other nations that characterized earlier eras of Western leadership.

The West, conversely, risks losing the very attribute that long legitimized its global role – the perception (however imperfect) that it stood for aspirational ideals.

Balaji says it very correctly:

This question remains open. It suggests that the geopolitical contest is not just for markets and bases, but for meaning and legitimacy in the international order.

Comments ()