Breaking NATO: Greenland Gambit and Minilateral Pivots

As Trump's Greenland moves grow more aggressive, European leaders are scrambling for new deals and relationships. Leaders are warning that this will collapse the current world order. Let us analyze.

The Island, the Bell, and the River

A monk once lived at the edge of a cold sea, where ice met iron ships. On the far horizon stood an island of stone and wind. Everyone argued over it.

One morning, a loud bell rang from the west. Its sound promised protection. But also demanded obedience.

Some villagers bowed. Some covered their ears. Some argued about the bell’s tone. Others quietly began building boats.

The monk said nothing.

A trader came and asked, “Master, who owns the island?”

The monk dropped a piece of copper into the sea. It sank. Then he dropped a piece of silver. It shimmered, then sank too.

“The sea owns what sinks,” he said.

“But the one who controls the shore decides who may fish.”

A soldier came next.

“Master, the alliance is breaking. One protector threatens tariffs, another offers dialogue. Should we choose a side?”

The monk pointed to a river that fed into the sea.

“In spring, the river listens to the mountain. In drought, it listens to the earth. Only a foolish river listens to the shouting on the shore.”

A scholar arrived, breathless.

“Multilateral halls are empty. New clubs form every season. Is this chaos?”

The monk smiled.

“When the old bridge weakens, travelers stop crossing together. They cross where the stones still hold.”

At dusk, the bell rang again. Louder, angrier.

Some boats returned to shore. Some sailed farther away. Some never waited for the bell at all.

The monk lit a lamp.

“Those who rely on the bell will fear silence. Those who rely on the island will fight over stone. Those who understand the river will endure.”

And the sea, indifferent to alliances and tariffs, kept moving—

responding only to gravity, depth, and time.

Thus, the world changed. Beyond egotist declarations. With quiet pivots.

SUPPORT DRISHTIKONE

In an increasingly complex and shifting world, thoughtful analysis is rare and essential. At Drishtikone, we dedicate hundreds of dollars and hours each month to producing deep, independent insights on geopolitics, culture, and global trends. Our work is rigorous, fearless, and free from advertising and external influence, sustained solely by the support of readers like you. For over two decades, Drishtikone has remained a one-person labor of commitment: no staff, no corporate funding — just a deep belief in the importance of perspective, truth, and analysis. If our work helps you better understand the forces shaping our world, we invite you to support it with your contribution by subscribing to the paid version or a one-time gift. Your support directly fuels independent thinking. To contribute, choose the USD equivalent amount you are comfortable with in your own currency. You can head to the Contribute page and use Stripe or PayPal to make a contribution.

Trump's Greenland Gambit

Exactly a year back, we had looked at Trump's then-interest in Greenland and its ramifications.

We have to remember that Trump’s focus on Greenland isn’t about a sudden whim. It is part of a broader geopolitical strategy linked to a new world order, not just Arctic symbolism.

Key points include:

- Arctic frontier as the next great strategic theater: with melting ice opening new shipping lanes, natural resources, and geopolitical competition among the U.S., Russia, China, and Europe.

- Trump frames Greenland as critical to U.S. national security, arguing that control of the island would give America strategic dominance in the High North ahead of rivals.

- Greenland’s rich natural resource potential. Specifically, rare earth elements, oil, gas, and minerals are central to this strategy. Access to these would help reduce reliance on China and strengthen U.S. industrial and defense capacity.

We had shared then as well that Trump’s approach (whether outright acquisition or coercive diplomacy) reflects a shift in tactics, not a fundamental change in American geostrategic direction.

We know that The U.S. has long eyed Greenland as a strategic asset, with past proposals to buy it dating back to the mid-20th century. Greenland’s role in Cold War strategy, particularly through U.S. military infrastructure like the Thule (now Pituffik Space Base), established an enduring American strategic presence.

While the U.S. doesn’t own Greenland as a sovereign territory, it already controls significant strategic footholds through long-standing defense arrangements:

- Pituffik Space Base (formerly Thule Air Base): The U.S. operates this key installation under bilateral agreements with Denmark. It’s vital for Arctic missile warning, space surveillance, and early detection of threats across polar regions.

- The U.S. maintains military and defense cooperation with Denmark and NATO in Greenland, which provides American forces access and strategic depth in the Arctic.

So the U.S. doesn’t need to own Greenland to exert influence. It already has deep strategic control via military and defense infrastructure.

With the new "Greenland Tariffs" now being touted by Donald Trump, this issue has grown bigger!

The "Greenland Tariffs"

Donald Trump’s threat to impose punitive tariffs on the European Union if NATO allies continue to oppose US moves aimed at asserting control or leverage over Greenland. While not formalized as a standalone tariff regime yet, the threats have been explicit enough to trigger contingency planning across European capitals.

The move is being called "Imperialist" by the Europeans.

According to reporting by BBC and ABC News, EU governments are preparing retaliation packages worth up to €93 billion, including counter-tariffs and potential restrictions on US companies’ access to the EU single market. These measures are being framed as leverage ahead of high-level encounters with Trump, notably around the World Economic Forum.

The dispute goes beyond trade. Greenland has become a strategic flashpoint due to Arctic security, critical minerals, and great-power competition, implicating NATO cohesion itself. For Europe, the episode reinforces a growing concern: when security dependence and economic coercion originate from the same ally, sovereignty risks multiply.

Strategically, the “Greenland tariffs” mark a shift from alliance management to transactional pressure politics, accelerating EU thinking on strategic autonomy, coordinated retaliation, and the limits of automatic Atlantic alignment.

Different Colors of Europe

Let us go through the responses from the leaders of various European countries regarding the disagreements over Greenland.

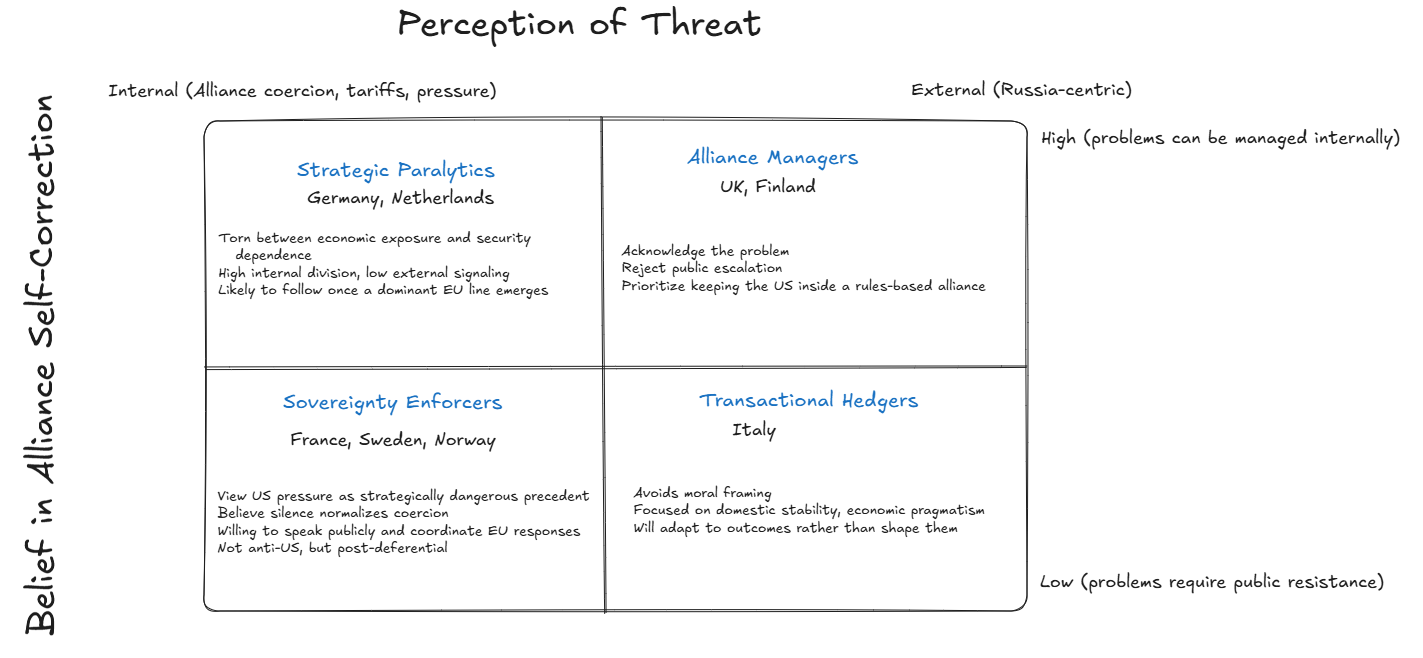

We are witnessing a divergence in how Europe interprets allied coercion.

- Some states now see US pressure as a strategic problem requiring pushback.

- Others still see it as an alliance dispute to be managed quietly.

- A few are immobilized, unsure whether to recalibrate or wait.

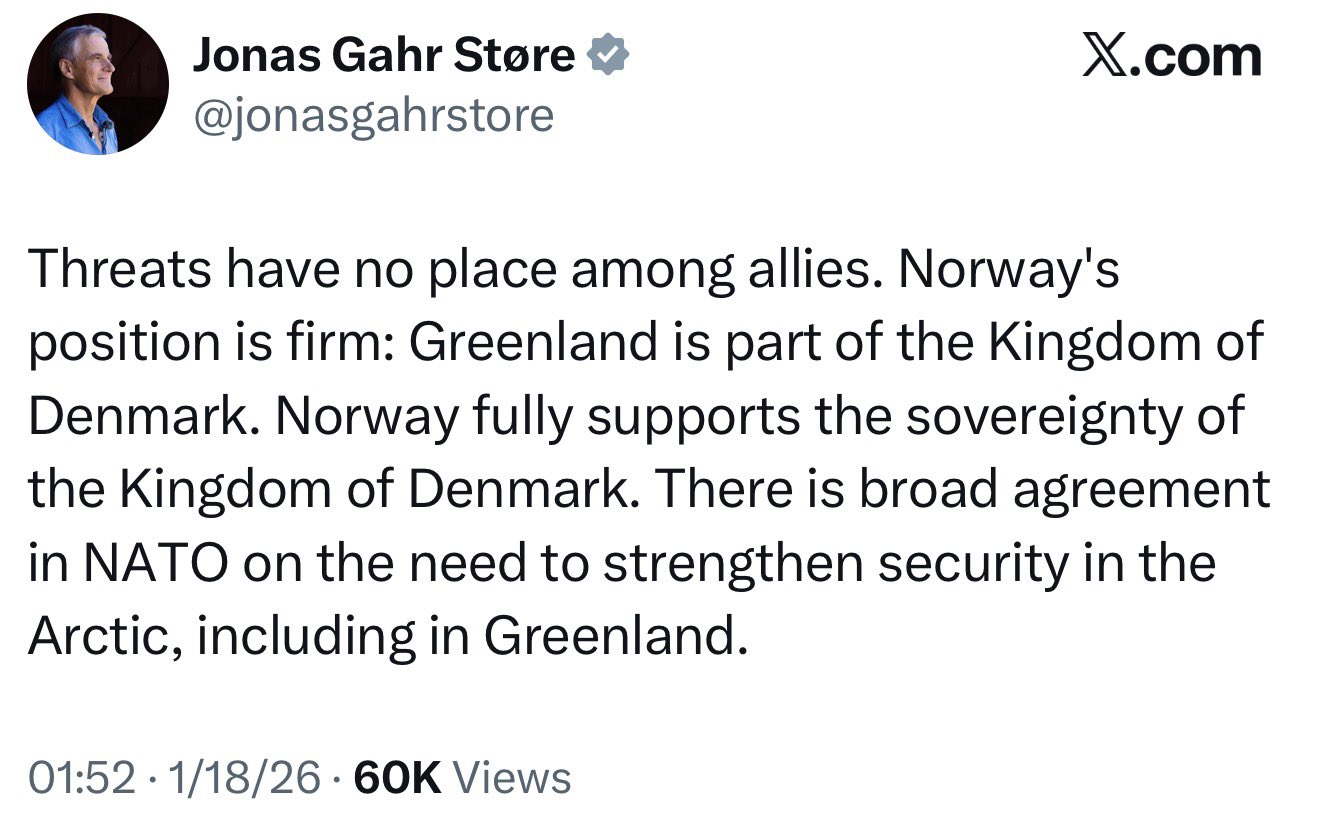

First, Norway.

And, Swedish Prime Minister.

The Finnish leader is one of those wishy-washy responses.

UK's Keir Starmer's statement reflects the pussillanimity that defines the British psyche today.

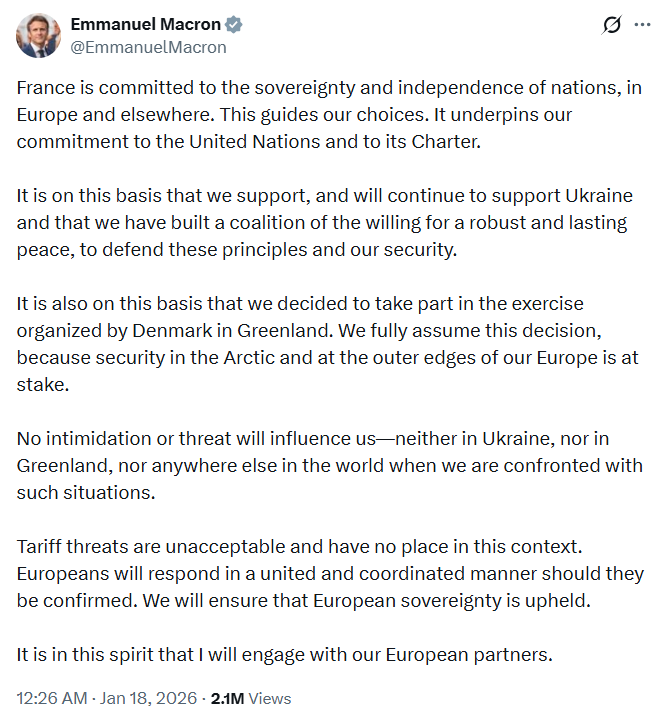

President Emmanuel Macron’s statement is significant not for what it says about Russia, but for what it implicitly says about the United States.

For the first time since the Ukraine war began, a leading European power has drawn an equivalence in method, not morality, between pressure exerted by Russia and pressure exerted by the US. Macron frames both through the same lens: sovereignty, intimidation, and unacceptable coercion, whether military, economic, or tariff-based.

This is a conceptual shift.

The statements from Ulf Kristersson and Macron are unusually direct. Sweden and France are not merely expressing discomfort; they are publicly calling out the United States, framing tariff threats and pressure over Greenland as violations of allied norms. Their language is assertive, coordinated, and deliberately multilateral (“EU issue,” “rules of the game,” “no blackmail”).

By contrast, Keir Starmer’s statement reflects a different posture. The UK complains clearly about tariffs and Arctic pressure, but keeps the dispute within alliance management channels, emphasizing dialogue “directly with the US administration.” This is not confrontation; it is hopeful containment—a belief that the alliance can self-correct.

So what do we have here?

Greenland matters not only because of the Arctic, but because it collapses several issues at once:

- pressure on an ally’s territory,

- economic coercion within NATO,

- and linkage of security cooperation with trade threats.

This forces Europe to answer a question it has avoided since 1949:

That question and not necessarily Russia is what explains the tone shift in Paris, Stockholm, and Oslo.

We can look at the different players within the matrix of Belief in NATO and Perception of the source of threat.

The unfolding transatlantic divergence signifies the onset of a post-automatic Atlanticism in Europe.

This conceptual separation was largely absent prior to 2022, when Atlantic solidarity tended to subsume these spheres under a singular strategic logic. The cumulative impact of the Ukraine conflict, energy disruptions, and U.S.- China systemic rivalry has encouraged European policymakers to reassess the costs and limits of automatic alignment.

Consequently, Europe’s transatlantic posture is evolving toward a more conditional, interest-calibrated relationship. One that emphasizes strategic autonomy while retaining security interdependence within the NATO framework.

Europe’s current strategic reorientation does not represent a pivot away from the United States but rather a departure from automatic alignment with it.

The shift reflects a transition from hierarchical dependency to relational parity within the transatlantic framework. President Macron’s statements, often misread as anti-American, should instead be interpreted as expressions of a post-hierarchical vision of alliance politics—one grounded in sovereign agency rather than subordination.

As Europe redefines the principles governing transatlantic cooperation, the structure of the Western alliance system itself is evolving.

Once alliances cease to operate through inherited hierarchies, the logic of global order becomes substantively multipolar rather than merely theoretical.

Europe’s repositioning thus marks not a breakdown of the transatlantic bond but its transformation into a more symmetrical configuration, where strategic convergence must be continually negotiated rather than presumed.

Reaching out to Russia

After years of inexplicable obstinacy, three of Europe's current leaders have made a U-turn and are willing to talk to Russia. It started with Macron and Meloni.

Then, a week later, German Chancellor Merz also joined the chorus.

The independent European countries and leadership will add its own heft that it has never dared to do hitherto.

We are looking at a world where alignment is becoming more transactional, more networked, and less binary. And a world where trade, industrial policy, and “economic security” do the heavy lifting that pure ideology once did.

Let us go through a bunch of interesting news reports to understand the pivot.

India as the Lever

In Gandhinagar, Narendra Modi and Friedrich Merz forged a decisive upgrade of India–Germany ties, sealing agreements spanning defence co-manufacturing, skills, healthcare, education, clean energy, climate action, and rare earths.

The pact targets strategic autonomy, supply-chain resilience, and advanced technology collaboration.

Germany reaffirmed India as a core strategic partner, pressed for an India–EU FTA, eased mobility for Indian health professionals, and deepened cooperation in energy transition, defence innovation, and people-to-people exchanges.

Building on the momentum of the Germany–India strategic reset, New Delhi now moves to lock in the wider European pillar. On January 27, 2026, Narendra Modi will host Ursula von der Leyen and António Costa for what is set to become India–EU’s largest-ever free trade agreement.

It is being called - Mother of all Deals!

While agriculture remains excluded due to domestic sensitivities, the deal sharply deepens economic integration.

It will expand Indian exports, secure supply-chain diversification amid U.S. tariff pressures, and strengthen Europe’s access to India’s technology, pharma, manufacturing, steel, automotive, and services ecosystems, while opening Indian markets to EU machinery, aircraft, chemicals, and high-value services.

Seen alongside the India–Germany reset and the impending India–EU FTA, Brussels’ parallel push into Latin America signals a deliberate European strategic decoupling from Washington’s shadow.

The European Union has now concluded a landmark free trade agreement with Mercosur in Asunción, creating a 700-million-consumer market spanning nearly a quarter of global GDP.

By dismantling over 90% of tariffs, the EU secures deep access to a region traditionally seen as part of the U.S. sphere of influence. This will entail exporting cars, machinery, wine, and high-value goods while locking in regulated agricultural imports.

Framed by EU leaders as a geopolitical necessity amid U.S. tariffs and Chinese competition, the deal underlines Europe’s quiet but unmistakable move toward autonomous power projection, even as internal resistance simmers over farming and environmental concerns.

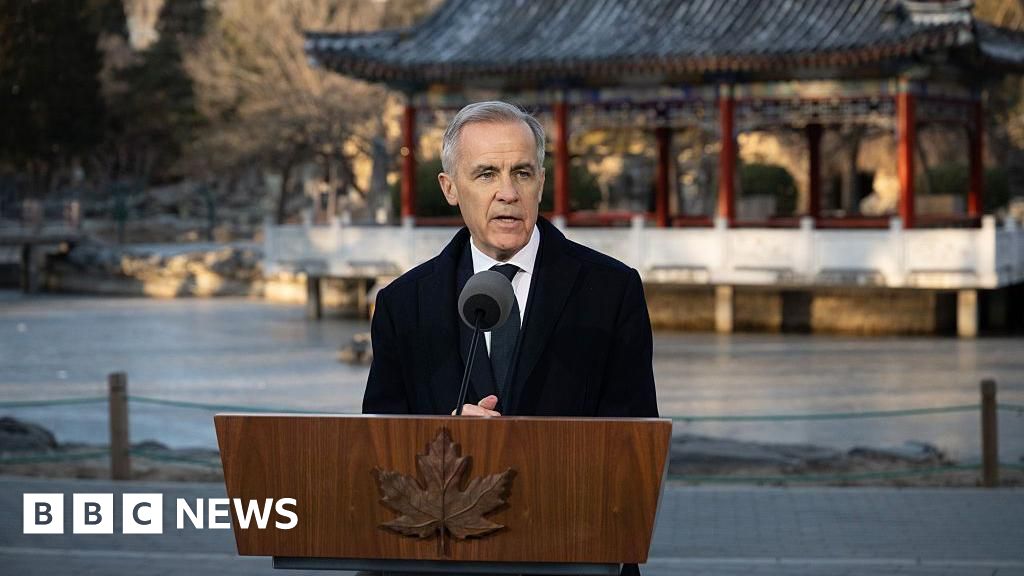

Canada's Pivot

Following Europe’s twin pivots toward India and Latin America, even Canada is now signalling a strategic break from reflexive alignment with Washington.

Mark Carney has openly framed Ottawa’s new trade accord with China as preparation for a “new world order,” easing EV tariffs and granting Beijing a commercial foothold directly adjacent to the United States.

This is less about affection for China than insurance against an unpredictable America.

With USMCA under strain and U.S. tariffs destabilising allies, Canada is asserting agency, prioritising economic security over ideological consistency. For Donald Trump, this is a warning signal: America’s pressure-first trade strategy is accelerating allied hedging. Europe diversifies, Canada recalibrates, Asia consolidates.

Trump’s world of unilateral leverage is giving way to a fragmented, transactional order in which even close allies build parallel options.

And U.S. influence is no longer assumed but negotiated.

There is another pivot underway - outreach from Italy to Japan, when Japan is working to upgrade its own military prowess.

Meloni-Takaichi - Lady Love

In their joint declaration, the leaders expressed "deep concern about all forms of economic coercion and the use of non-market policies and practices and the use of export restrictions that disrupt global supply chains," language directed at both China's export controls and Washington's protectionism under US President Donald Trump.

The Meloni–Takaichi embrace marks a quiet but consequential realignment in a system unsettled by US volatility after Donald Trump’s Greenland threats. By upgrading ties to a “special strategic partnership,” Giorgia Meloni and Sanae Takaichi are signaling that middle powers will no longer outsource resilience to Washington.

The partnership prioritizes defence-industrial autonomy, critical minerals security, and Africa-facing supply chains—explicitly reducing dependence on China while hedging against US protectionism. The centerpiece is the Global Combat Air Programme, a rare example of a major defence project progressing smoothly outside traditional US platforms. Economically, the focus on rare earths and non-market coercion reflects shared exposure to export controls—whether from Beijing or Washington.

In a fragmented order, Italy and Japan are building lateral trust networks: conservative-led, technologically anchored, and rules-focused.

The message is: strategic autonomy now grows through peer partnerships, not patronage.

China's US Debt Cutback

China’s decision to cut its US Treasury holdings to a 17-year low is not a tactical trade—it is a strategic signal. As reported, Beijing reduced holdings from about $760 bn in early 2025 to ~$683 bn, a near 10% drawdown in one year, after a brief pause in 2024. This acceleration aligns with a broader shift in reserves toward gold, which Chinese authorities have been steadily accumulating.

From a macro lens, this reflects three calculations. First, rising US debt and interest costs increase duration and political risk for large foreign holders. Second, Treasuries are no longer seen as geopolitically neutral assets; financial sanctions have weaponized reserve exposure. Third, in a world of slowing global demand and exploding sovereign issuance, China prefers hard, sanction-resistant stores of value over funding US fiscal expansion.

The move does not imply an imminent US debt crisis. Rather, it signals a long-term erosion of automatic foreign financing of US deficits. As other reserve holders quietly diversify, the burden of absorbing US debt increasingly shifts back to domestic markets—forcing Washington, sooner or later, to “clean its own house.”

Global Order Change

What we are witnessing is not a slow transition but a series of rapid pivots, each triggered by pressure at a chokepoint—security, trade, energy, technology, or commodities. The old architecture of globalization assumed that multilateral institutions would absorb shocks and arbitrate disputes. That assumption has collapsed. What is replacing it is a world of minilaterals, material constraints, and transactional alignments.

As outlined in Drishtikone’s analysis of the coming silver and copper catastrophe, the global system is now colliding with physical limits.

What does this mean?

Minilaterals are the political expression of this reality.

The Quad, AUKUS, I2U2, EU–Mercosur, and INSTC are not ideological clubs; they are function-specific survival pacts. States now separate security alignment from trade alignment and from payments alignment.

Energy illustrates the danger.

The Russia–China–Iran axis controls a dominant share of oil and gas reserves, while Europe, having severed Russian supply, has substituted flexibility with fragility, relying on US LNG at a structural price premium.

Technology deepens the split. Semiconductors reveal mutual vulnerability: Taiwan manufactures, the US designs and supplies equipment, China assembles and scales. No one can walk away without severe damage. Hence, we see dual ecosystems emerging rather than clean separation—Atlantic and Eurasian—with diverging standards and declining interoperability.

This is where silver and copper become decisive. Copper is the bloodstream of electrification, grids, EVs, and military hardware. Silver is indispensable to solar, electronics, and advanced weapons.

As we argued in our previous newsletter, looming shortages are not cyclical—they are structural.

When supply cannot scale fast enough, price becomes a strategy.

States will hoard, weaponize export controls, and lock in bilateral supply agreements. Markets will no longer clear smoothly; they will fracture politically.

Payment systems mirror this shift. SWIFT’s weaponization has accelerated alternatives—CIPS, UPI linkages, BRICS+ settlement experiments—not to overthrow the dollar overnight, but to reduce exposure at the margins.

The emerging world order is therefore not multipolar in a classical sense. It is polycentric and brittle—held together by overlapping deals, constrained by material scarcity, and prone to sudden realignments when a single node fails.

In such a system, the speed of the pivot becomes power.

Those who control scale, resources, and adaptability will shape outcomes. Those who rely on assumptions will be shocked. Again and again.

Now let us ask ourselves the question that is staring in our faces. Also, look at what it really means.

Is NATO breaking up? And what would that mean for the new world order?

NATO is undergoing its most severe internal stress since its creation in 1949.

The Greenland episode has exposed a structural truth that many in Europe long avoided: alliances survive on trust, not just treaties.

When the most powerful member of an alliance openly threatens territorial coercion against another member, the alliance’s moral and strategic foundation begins to fracture.

NATO was built on a simple premise: collective defense against external aggression.

Article 5 assumes a clear distinction between the protector and the aggressor. What it never envisioned was an internal imperial challenge. When Donald Trump speaks of acquiring Greenland “by any means necessary,” he collapses that distinction. The threat is not legal ambiguity; it is political betrayal.

This is why voices in Europe argue that Trump now poses a greater immediate danger to NATO’s cohesion than Vladimir Putin.

Russia tests NATO from the outside.

The reaction from Poland is telling.

Warsaw understands NATO as a civilizational shield, not merely a military arrangement. Polish leaders warning that such a rupture would be “the end of the world as we know it” are not exaggerating. A U.S.-on-ally confrontation would shatter the credibility of deterrence, encourage strategic hedging, and accelerate European rearmament outside NATO’s command structure.

In practical terms, NATO would not explode overnight. Instead, it would hollow out. Intelligence sharing would thin. Joint planning would become conditional. European states would quietly build parallel security architectures—through the EU, ad-hoc coalitions, or bilateral pacts—designed explicitly to reduce dependence on Washington. Trust, once lost, does not reset with a change of administration.

For the emerging world order, the ramifications are profound. A weakened NATO accelerates multipolarity, but not the stable kind. It invites regional arms races, legitimizes coercive territorial revisionism, and blurs the moral line between liberal democracies and authoritarian powers. The United Nations system, already strained, would struggle to restrain great-power precedent.

Comments ()